James L. Halperin and Gregory J. Rohan

The Collector’s

Handbook

14th Edition

Tax Planning, Strategy and Estate

Advice for Collectors and Their Heirs

THE COLLECTOR’S HANDBOOK

Collector’s

Handbook

The

Tax Planning, Strategy and Estate

Advice for Collectors and Their Heirs

James L. Halperin and Gregory J. Rohan

Edited by

Noah Fleisher, Brian Keagy,

Steve Lansdale and Steve Roach

Dallas, Texas

Collector’s

Handbook

The

By James L. Halperin and Gregory J. Rohan

Edited for 2023 by Brian Keagy and Steve Lansdale.

Copyright 2000, 2004, 2007, 2008, 2009, 2011, 2012, 2013, 2014, 2015, 2016, 2018,

2019, 2020, 2023 by James L. Halperin and Gregory J. Rohan

All Rights Reserved. Reproduction or translation of any part of this work without

permission of the copyright owners is unlawful. Written requests for permission or

further information should be addressed to:

Ivy Press

2801 W. Airport Freeway

Dallas, TX 75261-4127

This publication is designed to provide accurate and authoritative information with

respect to the subject matter covered. It is provided with the understanding that

neither the authors nor the publisher are engaged in rendering legal, accounting, or

other professional advice. If legal advice or other expert assistance is required, you

should seek the services of a competent professional.

Choose the members of your financial team wisely, and don’t be afraid to pay for

good advice; it will save you money in the long run. You will likely need a CPA,

a lawyer, a financial planner, and an insurance agent to execute the planning

recommended in this book. Encourage your entire team to work together; a financial

plan is only as good as it is holistic. Please remember that tax planning is an ongoing

process and not an annual event. Collectors have special needs, and tax laws affect

different collectors differently.

ISBN: 978-1-63351-472-0

Manufactured in the United States of America

© 2023, Revised Edition

Copyright Cover Design by Jonathan Fehr, 2023

A True Collector’s Mentality

“My wish is, so that my drawings, my prints, my

curiosities, my books, in a word, those things of

Art which have been the joy of my life shall not

be consigned to the cold tomb of a museum, and

subjected to the stupid glance of the careless

passer-by; but I require that they shall all be

dispersed under the hammer of the auctioneer,

so that the pleasure which the acquiring of each

one has given to me, shall be given again, in

each case, to some inheritor of my own tastes.”

From the will of Edmond de Goncourt, 1896

“…helpful summaries about care of collections,

security, and tax pitfalls.

”

– The Philadelphia Inquirer

“Minimize inheritance headaches and heartaches…

Experts’ tips for winning encounters with coin

dealers and the IRS.

”

– The Centinel

“…your heirs deserve knowledge and truth about your

holdings. Your use of this book should help, and—especially

for those of you with a valuable collection—a copy for your heirs would

not be amiss.

”

– COINage Coin Collector's Yearbook

“…deserves to be in the hands of any collector of coins,

serious or frivolous. It gives excellent advice for maintaining records, caring

for, safeguarding and for disposing of a numismatic collection. Dealers

would do well to recommend it to their customers –

after reading it themselves.

”

– Col. Bill Murray, Noted Columnist

“

…by far the best book written on how to ensure that your

coin collection is never sold for pennies on the dollar.

A book I highly recommend to all my clients.

”

– Dale Williams, Professional Numismatist

“How comprehensive is this book? I put it with my collection and told

my daughter Sara to read it when it comes to

handling my coin estate.

”

– Fred Weinberg, Past President of the Professional

Numismatists Guild

“In summary, this small paperback book contains a wealth of information

for collectors at all levels of the hobby. You can read it over a weekend, and

I would urge you to share it with your potential heirs. If nothing else,

place a copy on top of your collection, with important (to you)

sections highlighted. Your heirs will be glad you did.

”

– Mike Thorne, Writer. Coins Magazine

Estate Planning Made Easy, June 3, 2009

“Must reading for most of today’s collectors.”

– Coins Magazine

“To those of us in the business of helping remove obstacles from the

financial paths of clients, The Collector’s Handbook is a valuable resource I

would think that any advisor would want to have in their library.

”

- Jeffrey Turner, Certified Financial Planner™ professional,

President of Chattanooga Estate Planning Council

“A wealth of sound and practical information, written in a clear and

concise manner. Must reading for every collector!

”

– Leroy Van Allen, Numismatic Author and Morgan Dollar Expert

“…It is for everyone in numismatics and is even a ‘must have’ for those

who may become heirs, but lack the know-how of what to do next. Senior

citizens, like myself, will be especially happy with the interesting stories of

estates, etc. … EVERYONE should

own it if coins are involved in their activities.

I highly recommend this book…

”

– Lee Martin, Founder of the Numismatic Literary Guild

The first edition of this book, titled

The Rare Coin Estate Handbook, received many of

the comments and endorsements listed above, and

won the Robert Friedberg Award from the Professional

Numismatists Guild: Best Numismatic Book of the Year.

Now rewritten for all forms of art, jewelry

and collectibles, the 7th Edition of The Collector’s

Handbook received the “Extraordinary Merit” award

from the Numismatic Literary Guild in 2013

.

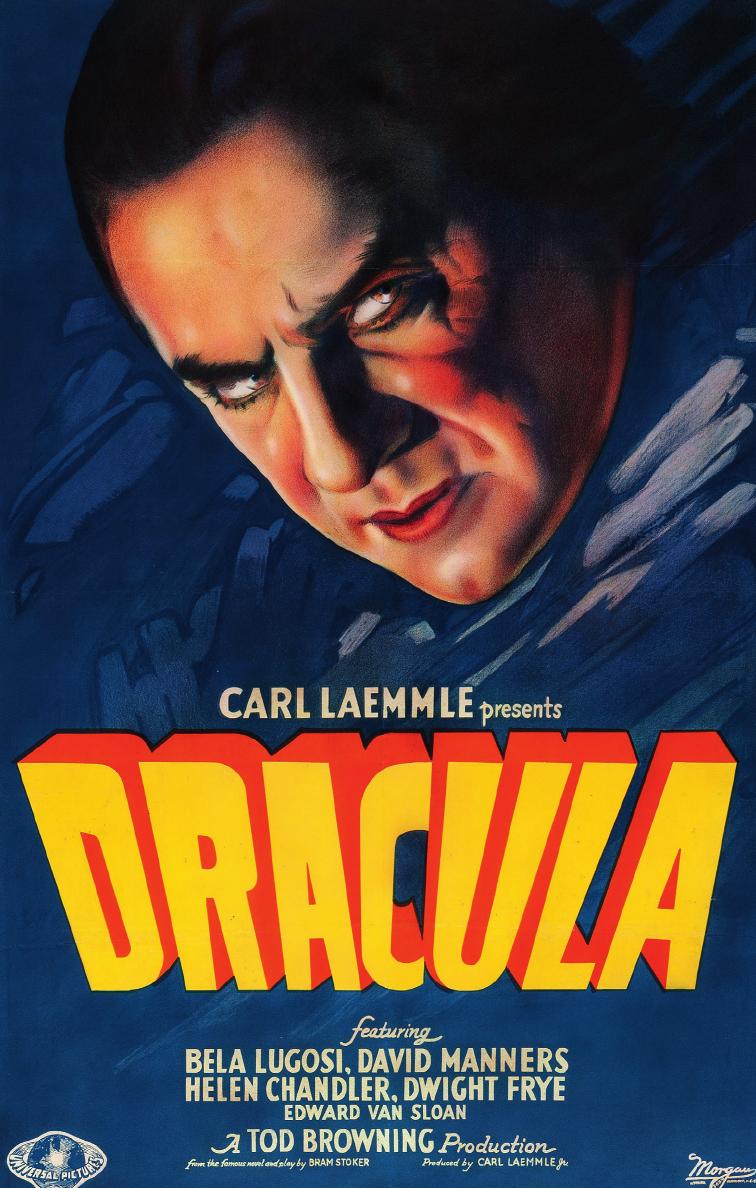

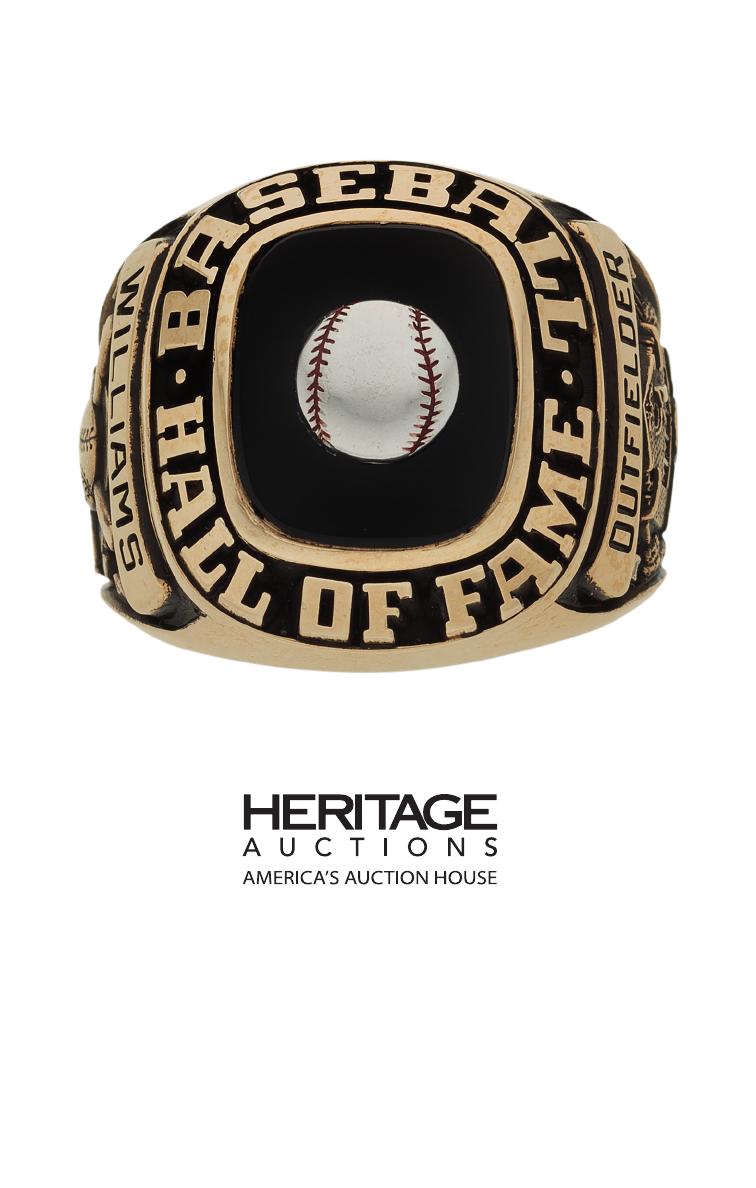

Front Cover:

Rolex, Very Fine and Rare 14k Gold

Ref. 6241 “Paul Newman” Cosmograph

Daytona “John Player Special”, Circa 1969

Sold for $804,500 | October 2018

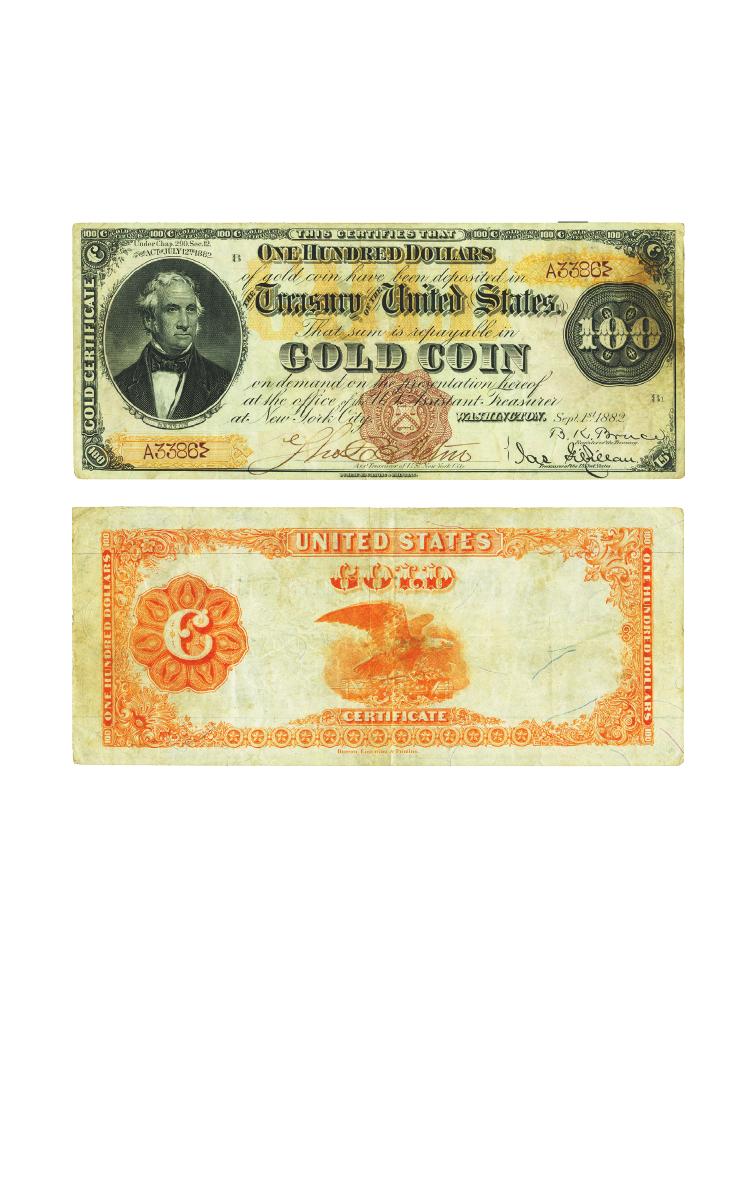

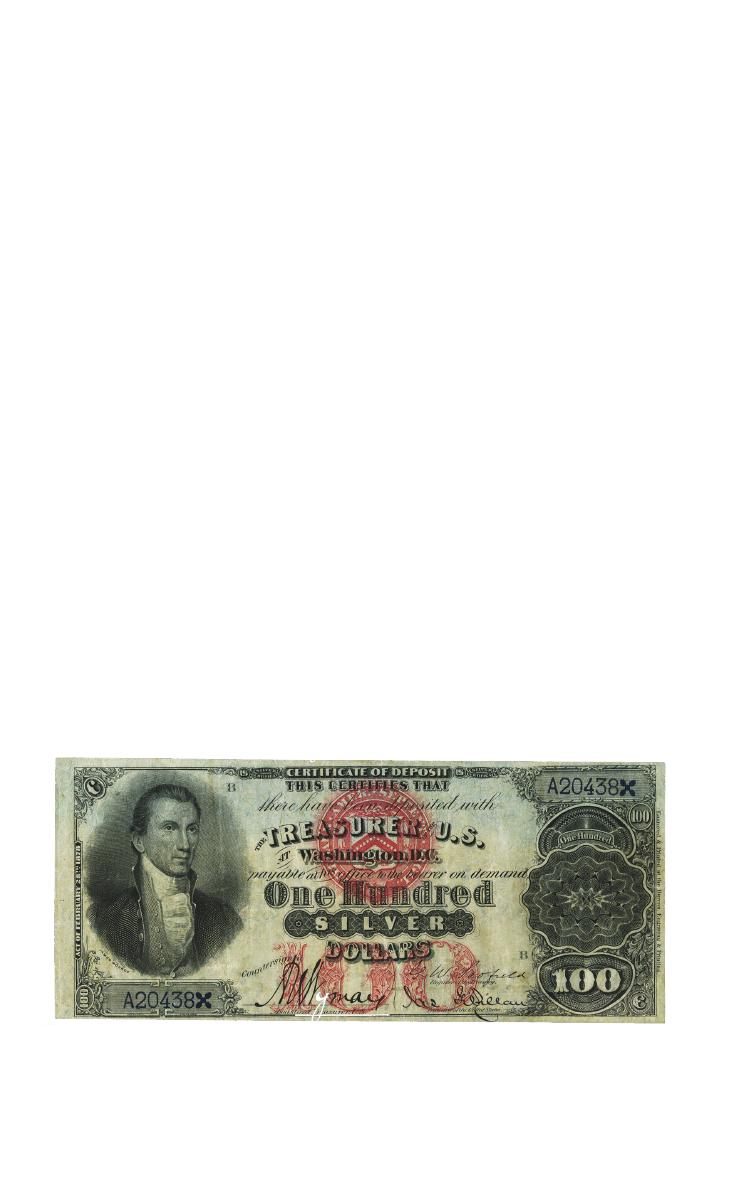

Fr. 1202 $100 1882 Gold Certificate

PMG Very Fine 30

Sold for $750,000 | October 2022

1885 Trade Dollar

Finest of Five Examples Known

Sold for $3,960,000 | January 2019

Contents

Foreword xvii

Acknowledgements ixxi

Introduction ixxiii

PART 1: ADMINISTERING YOUR COLLECTION

Chapter 1 – Recordkeeping 3

Chapter 2 – Caring for Your Collection 9

Chapter 3 – Safeguarding Your Collection 21

PART 2: ESTATE PLANNING FOR YOUR COLLECTION

Chapter 4 – All in the Family 35

Chapter 5 – Division of Assets 49

Chapter 6 – Should You Bequeath Your Collection,

or Sell During Your Lifetime? 59

Chapter 7 – Collectibles, Estate Planning and Taxes 71

Chapter 8 – Collectibles and Charitable Giving 93

PART 3: EVALUATING YOUR COLLECTION

Chapter 9 – Third-Party Authentication and Grading 109

Chapter 10 – Having Your Collection Appraised 115

PART 4: SELLING YOUR COLLECTION

Chapter 11 – Selling Your Collection Through Outright Sale 129

Chapter 12 – Selling Your Collectibles Through an Agent 137

Chapter 13 – Selling Your Collection at Auction 147

Chapter 14 – Etiquette & Tips 159

APPENDICES

Appendix A – Organizations for Collectors 170

Appendix B – Insurance Companies Offering Specialized

Coverage for Collectors 172

Appendix C – Third-Party Grading Services 174

Appendix D – Selected Publications for Collectors 175

1861 $20 Paquet

MS67 PCGS. CAC

Sold for $7,200,000 | August 2021

Foreword

WHY WE COLLECT THINGS

M

y friend John Jay Pittman did not start out a wealthy man. Slowly

and with dedication, he assembled an incredible coin collection.

He accomplished this through relentless study and at the cost of

a significant portion of his limited income as a middle manager for

Eastman Kodak, supplemented by his wife’s income as a schoolteacher.

In 1954, John mortgaged the family house to travel to Egypt and bid on

coins at the King Farouk Collection auction, and he demanded many

more sacrifices of himself and his family over the decades. He passed

away in 1996 with no apparent regrets, and his long-suffering family

deservingly reaped the rewards of his efforts when the collection was

sold at auction for more than $30 million.

But why did he do it?

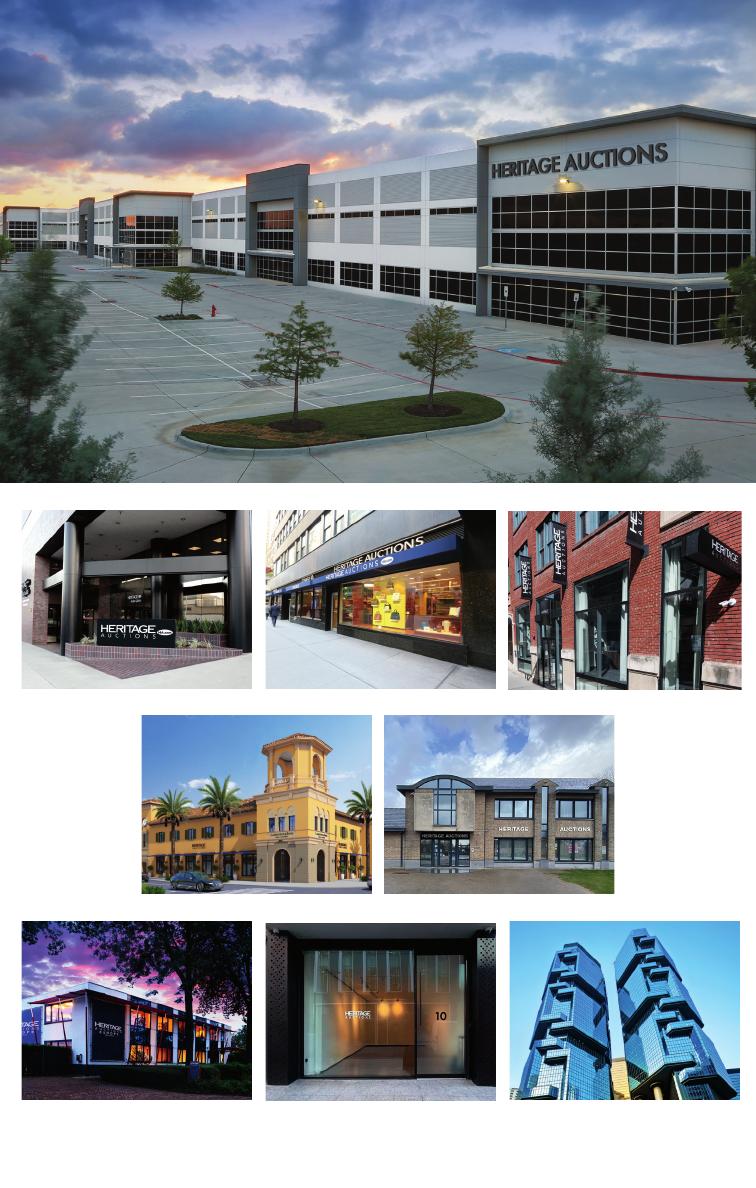

On our website, HA.com, we auction many different types of collectibles;

what started in 1976 as a numismatics business is now the largest

auction house founded in America — with annual sales exceeding

$1.45 billion in 2022 in categories ranging from meteorites to Hermès

handbags. Most of our more than 1.75 million registered client/bidders

collect in more than one area, which we can determine through online

surveys, free catalog subscriptions, and multiple drawings for prizes

throughout the year. Our clients pursue many different collecting areas,

and for many different reasons.

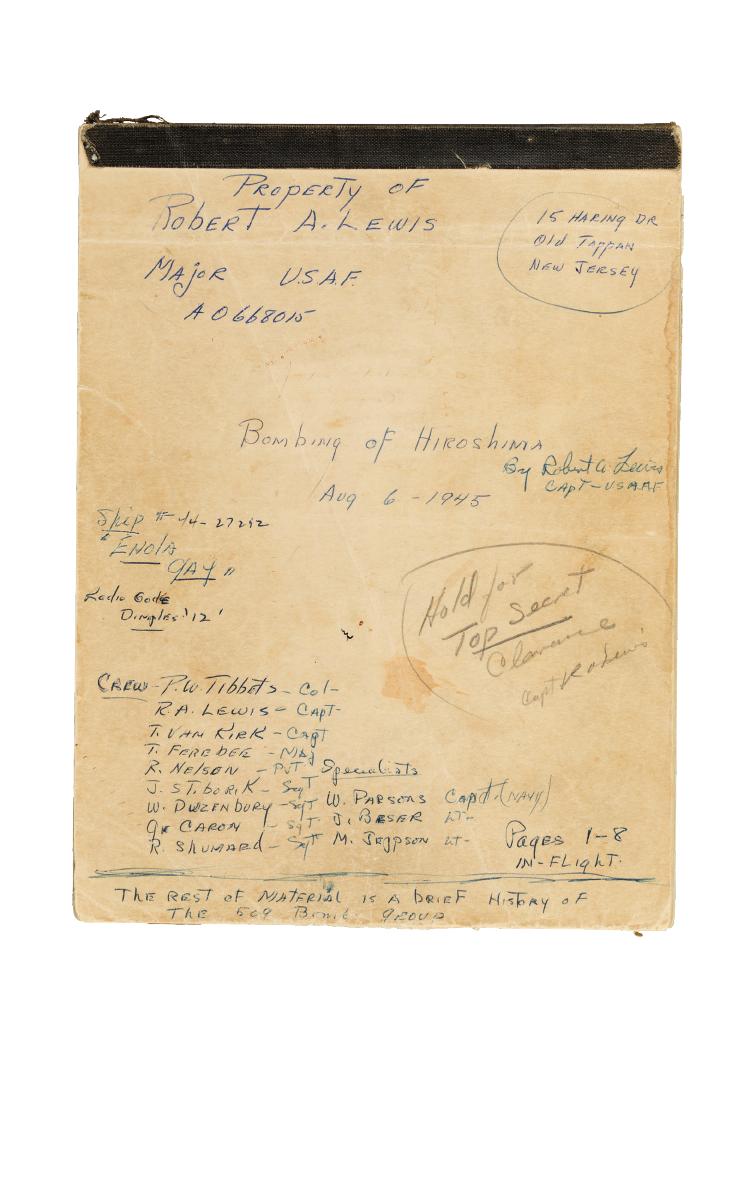

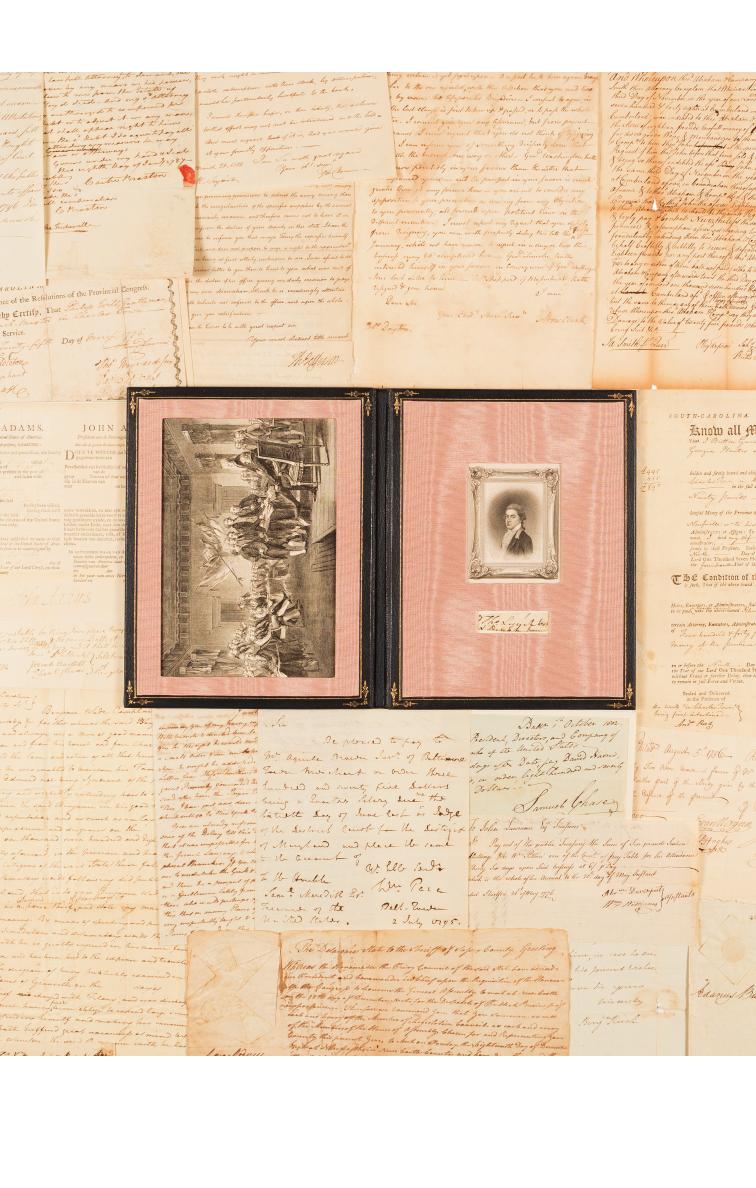

One fervent collector of historical documents refers to his passion as “a

genetic defect.” The founding father of psychoanalysis Sigmund Freud,

a renowned collector in his own right, thought that collecting was really

about sex: “The core of paranoia is the detachment of the libido from

objects,” he wrote in 1908. “A reverse course is taken by the collector

who directs his surplus libido into an inanimate object: a love of things.”

But more likely it’s basic human instinct: a survival advantage amplified

by eons of natural selection. Those of our ancient ancestors who

managed to accumulate scarce objects may have been more likely to

survive long enough to bear offspring—and people who owned shiny

objects may have had an easier time attracting mates. Even today,

wealth correlates with longer life expectancy; and could any form of

wealth be more primal than scarce, tangible objects?

While the thrill of the hunt and a passion for objects — whether it’s

Lithuanian first-day covers or Alberto Vargas paintings — is what

motivates and excites collectors, there are, alas, some housekeeping

chores that must be tended to in order to assure that you derive the

most benefit from your collection. Whether that means minimizing

your tax burden, ensuring that your objects are safe from intruders, or

maximizing your collection’s value for your heirs, a little attention now

can save you a massive headache later. It also will help you to get as

much as you can out of the top 10 reasons Heritage Auctions’ clients

tell us that they collect (not in order):

1. Knowledge and learning

2. Relaxation and stress reduction

3. Personal pleasure

4. Social interaction with fellow collectors

5. Competitive challenge

6. Public recognition

7. Altruism (leaving a collection to a museum or non-profit organization)

8. The desire to control, possess and bring order to something

9. Nostalgia and/or a connection to history

10. Accumulation and diversification of wealth

Like Pittman, Robert Lesser is a true collector, but also a visionary with

the ability to change his own course. He funded his later collections

by assembling a fine collection of Disney memorabilia before it was

popular, and later sold it for a seven-figure sum after the collecting

world had come to appreciate it. Long before others discovered Disney

memorabilia’s now-obvious appeal, Lesser assembled preeminent

collections of toy robots—museum exhibitions of his collection have

attracted sell-out crowds with waiting lines stretching over city blocks—

and pulp magazine cover paintings.

Many non-acquisitive pastimes provide similar levels of satisfaction,

knowledge and recognition, along with the other benefits of collecting.

But unlike home gardeners and tropical fish enthusiasts, serious

collectors of rare objects will very often find that they have created

substantial wealth—especially if they recognize this as one of the goals

of their collections.

Whatever your motivation for collecting, this book will make you a more

intelligent collector. Following the advice of our expert team of industry

professionals, accountants, and lawyers will help you enjoy your

collection more and ensure that your heirs can benefit from your legacy.

James L. Halperin

Co-Chairman, Heritage Auctions

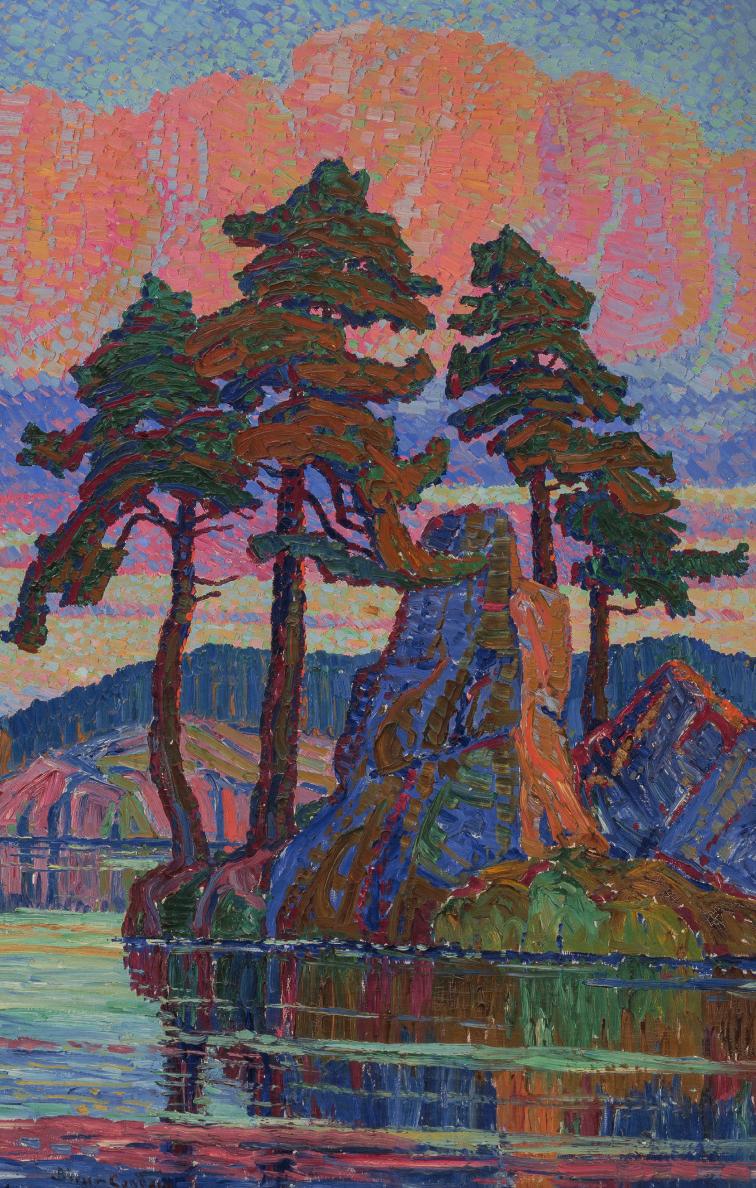

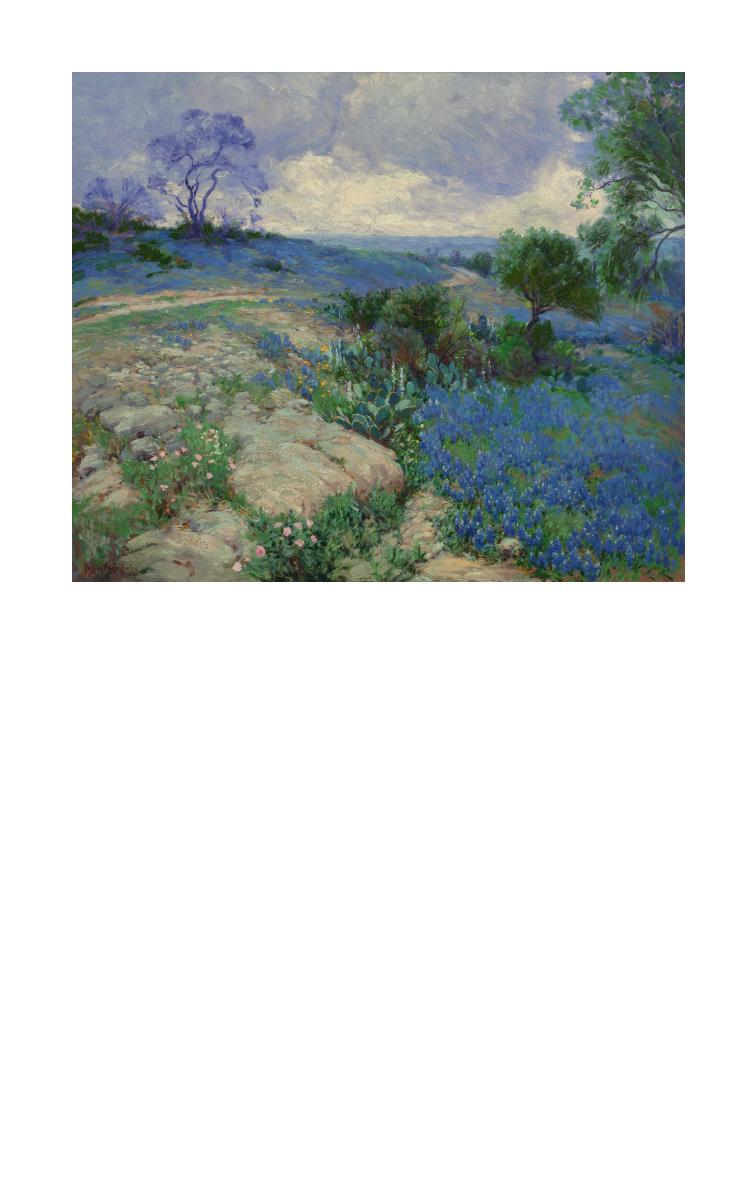

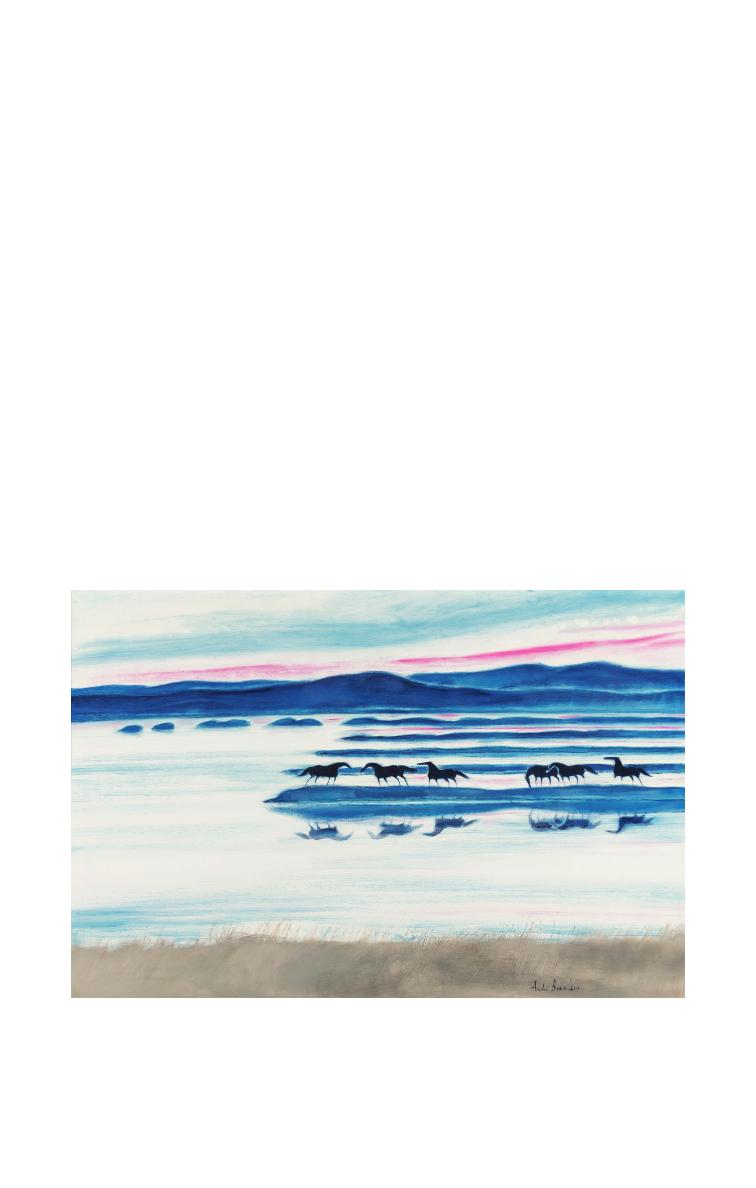

Birger Sandzén (American, 1871-1954)

Lake at Sunset, Colorado, 1921

Oil on canvas

80 x 60 inches

Sold for $670,000 | May 2016

PROPERTY FROM A MIDWESTERN INSTITUTION

WORLD AUCTION RECORD FOR THE ARTIST

Acknowledgements

W

riting a book is like forming a great collection: many people

contribute in many different ways. While collecting, we build

on the work of dealers, auction firms, friends old and new, and those

dedicated authors whose reference books line our shelves. It is no

different here. We offer many thanks to the following for their assistance

during the preparation of this work:

Steve Ivy, Bob Korver, Burnett Marus, Steve Roach, Matthew S. Wilcox,

Will Rossman, Richard Freeland, Noah Fleisher, Mark Van Winkle, Mark

Masat, Brian Keagy, Michelle Castro, Taylor Strander, Deborah Daly,

Steve Lansdale, Brett Flagg, Chris Britton, Jonathan Fehr, and Emily

Murrah.

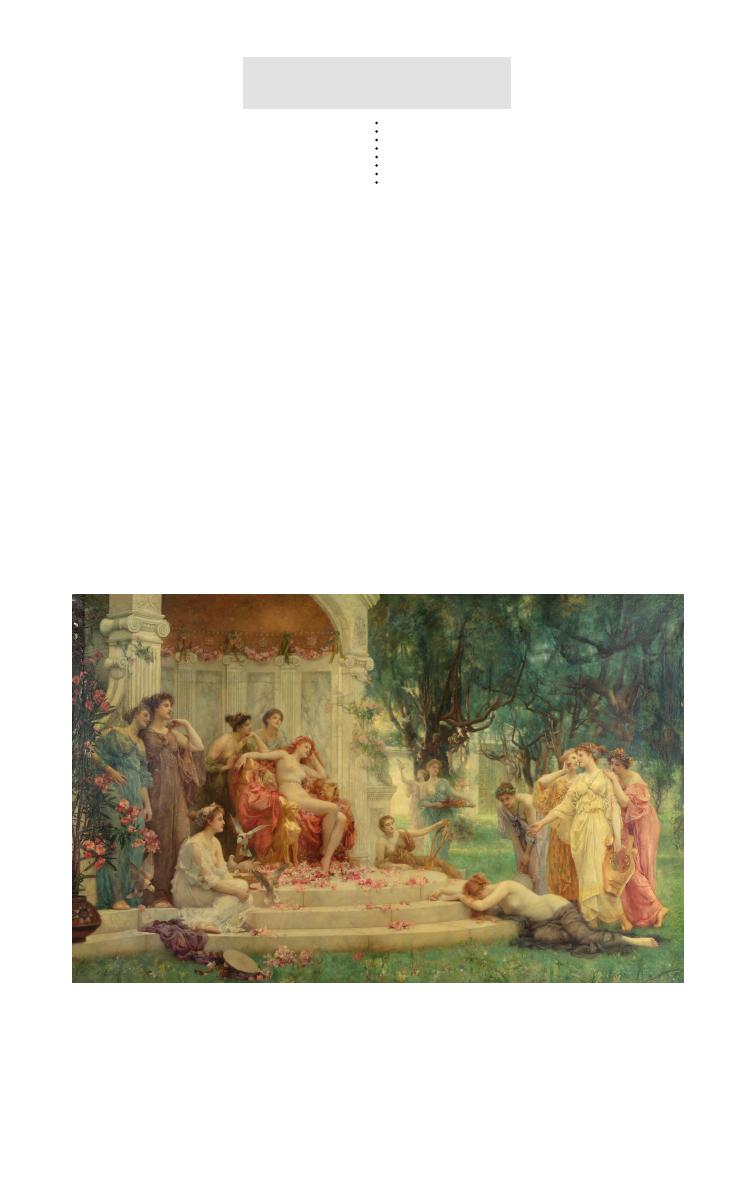

Henrietta Rae (British, 1859-1928)

Psyche before the throne of Venus, 1894

Oil on canvas

76-1/2 x 120 inches

Sold for $324,500 | May 2017

PROPERTY OF A TEXAS MUSEUM

Charlton Heston “Moses”

Signature Robe from

The Ten Commandments

(Paramount, 1956).

Sold for $447,000 | December 2022

Introduction

Collectors know the joy that comes from being surrounded by

wonderful objects. The study of the pieces in our collections adds

depth, color, and richness to our lives. We also know that a collection

is intensely personal, and thus can be infrequently shared with others.

You know your collection intimately. More than likely, your heirs do not.

Heritage’s Appraisal Services team once encountered a collector who

showed up at an appraisal fair with a meticulously kept book detailing

every object she had in her collection: when she bought it, who she

bought it from, what she paid for it and everything she knew about it.

Such meticulousness is rare. All too often, the chaos left behind by

collectors leaves their descendants with a tax burden that could have

been avoided, along with endless amounts of paperwork, legal fees,

wrangling and other drama.

The principals at Heritage Auctions have written this book to provide

information essential to collectors organizing their collections, advisors

working with these collections and heirs who have inherited collections.

Organizations that have received collections as donations also will

benefit from this book.

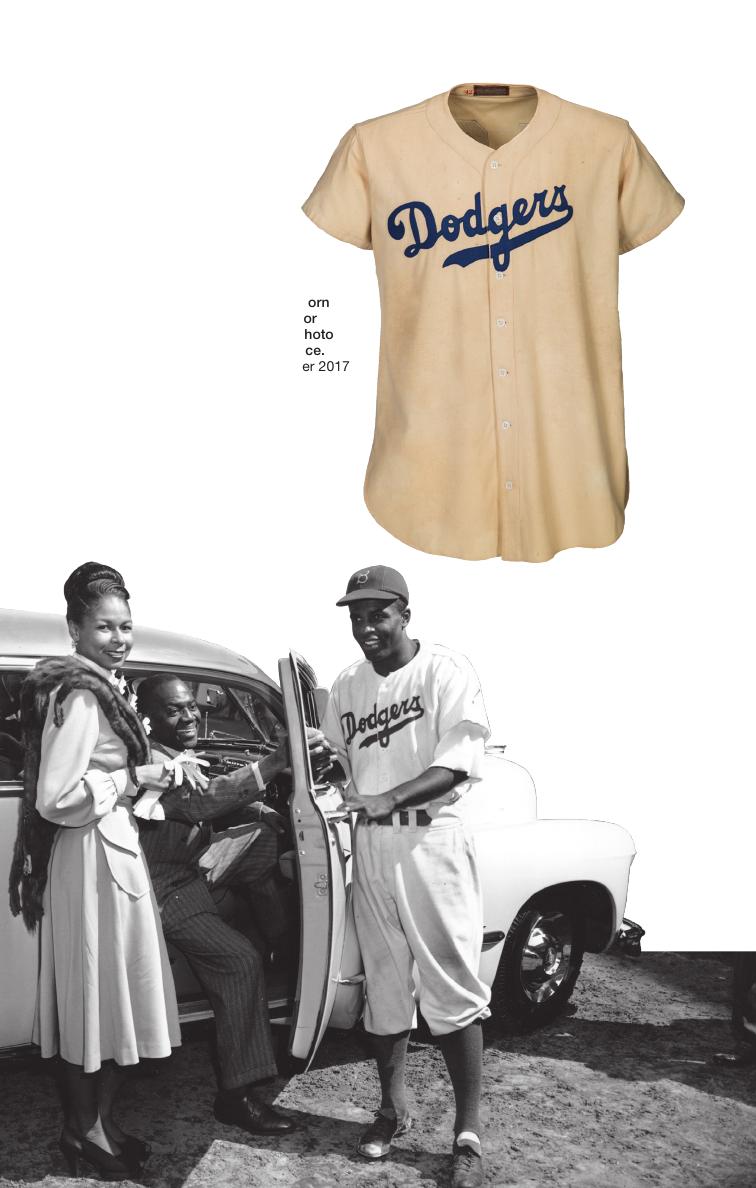

1947 Jackie Robinson Game Worn

Brooklyn Dodgers Rookie “Color

Barrier” Jersey, MEARS A9 – Photo

Matched with Family Provenance.

Sold for $2,050,000 | November 2017

Administering Your Collection

PART ONE

2

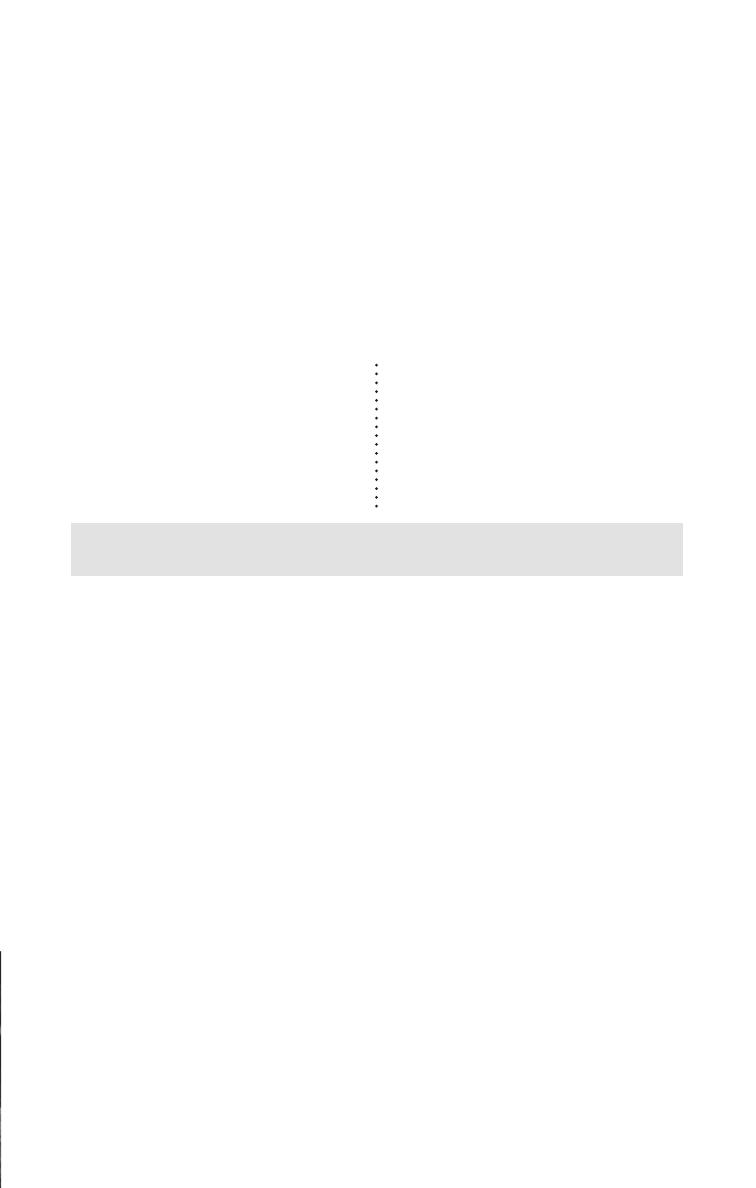

Action Comics #1 Rocket Copy (DC, 1938)

CGC FN 6.0 White pages.

Sold for $3,180,000 | January 2022

3

1

Recordkeeping

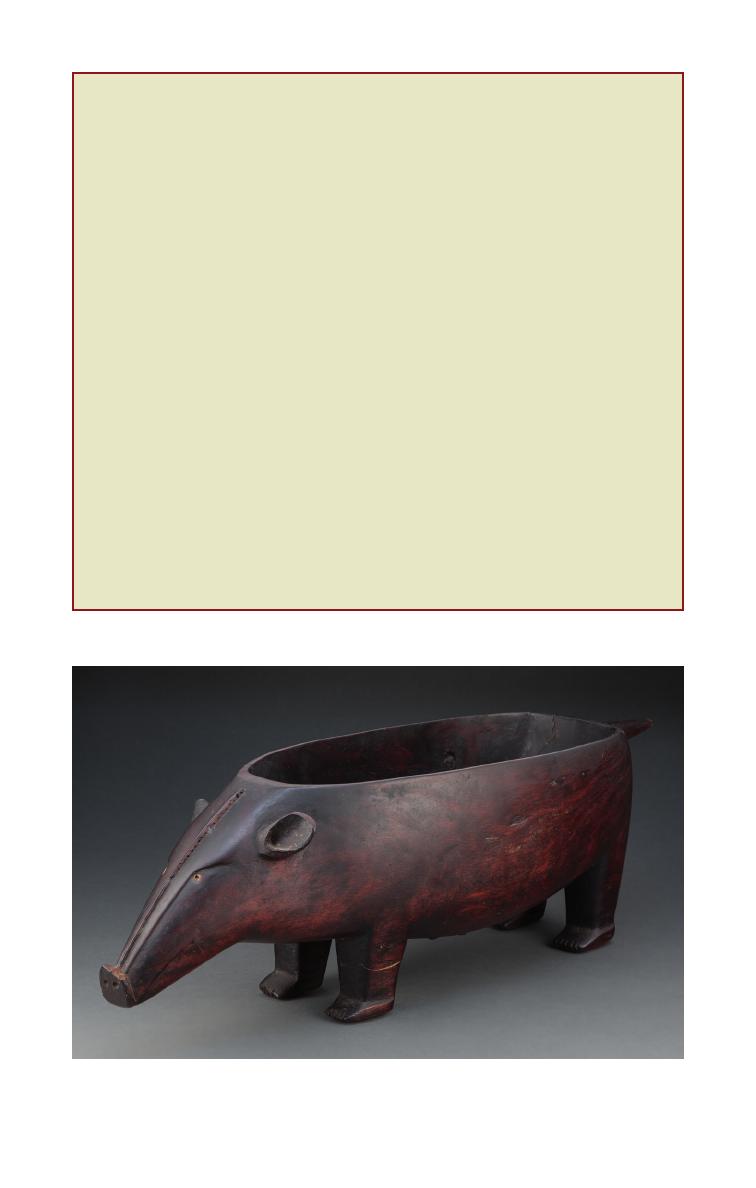

Mother: “This is the fertility vase of the Ndebele tribe.

Does that mean anything to you?”

Daughter: “No?” – From the 2004 movie Mean Girls

W

e once appraised a home with six federal mahogany chests of

drawers. The deceased’s estate plan stipulated that a certain heir

should receive “the good one.” While the collector certainly understood

which of the six was “the good one,” he was not there to help—and the

executor and attorney had no idea what he was talking about.

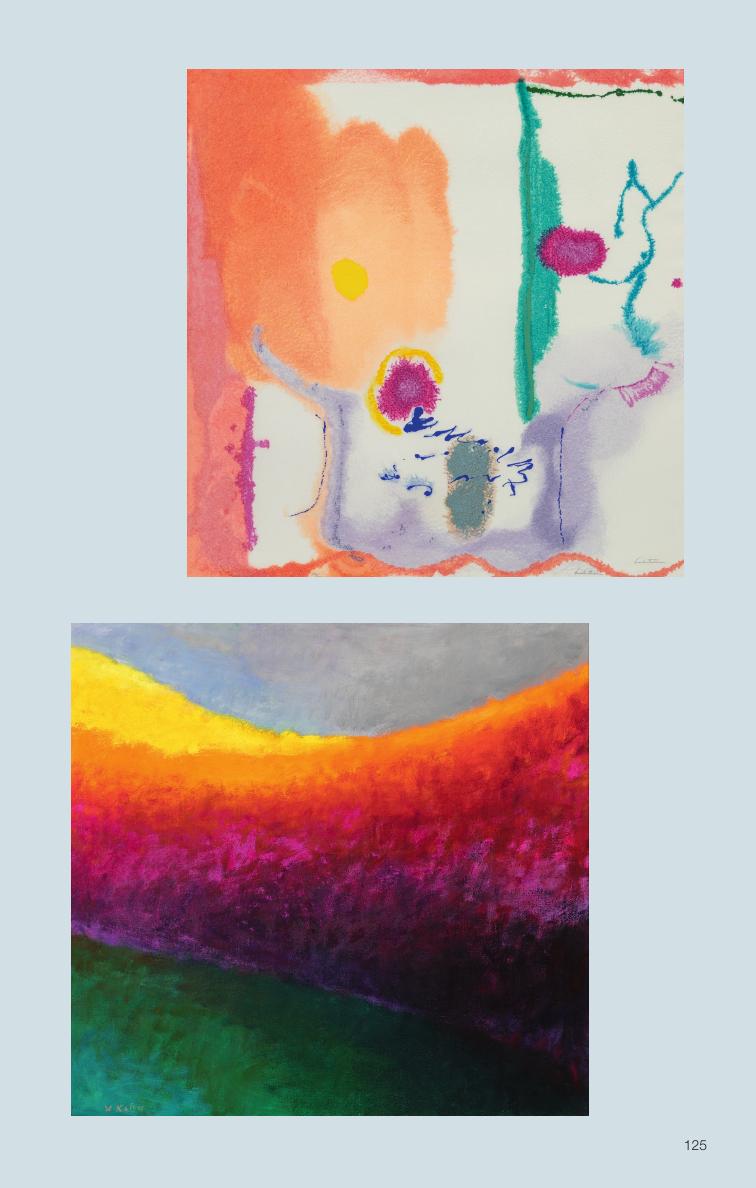

In another case involving a room full of paintings, the estate plan

provided instructions for a certain painting: “the one with the

banana.” The heirs, executor and attorney all looked to us to

determine which painting represented a banana. Unfortunately, it was

impossible to find any resemblance in the group because all of the

pieces were entirely abstract.

These situations sound like vaudeville skits, but both really happened—

and they could have been avoided if the collections had been

inventoried and numbered. Even when the terms of the will specify

the exact location of an item in an effort to distinguish it from similar

ones, it may not be enough. As collectors relocate, downsize, or simply

rearrange their homes, the location of an item may change. Assigning

a unique identification number does not change and therefore remains

the only reliable method of inventorying items that we recommend.

Documenting what you own by writing it down by hand or in a

printable listing is the most fundamental part of intelligent collections

management. For historians and scholars, original handwritten

inventories have proved to be invaluable tools with tasks as varied as

accurately restoring a historic building, understanding a major battle or

reconstructing a seminal art collection. The oldest known examples of

4

writing in Europe are lists of commodities found in the storerooms of

palaces in Ancient Greece. Modern technology has made the process

easier than ever, and all collectors must understand the importance

of proper documentation: It will be essential to your relationships with

insurers, dealers, auction houses, the IRS and your heirs. Inputting and

documenting each new acquisition as you proceed makes this process

manageable.

The first question to answer: handwritten or digital? While it’s possible

to maintain meticulous paper records, our preference is that you use

a computer program that is properly backed up in case of computer

issues by a simple Excel spreadsheet, a Quicken list, a personal

website, handwritten note cards, the MyCollection™ feature on the

Heritage website or even some private software options like Collectify

®

.

While doing anything at all will put you far ahead of most collectors,

the more detailed, uniform and decipherable your inventory method

is to the novice eye, the better. Your inventory system must be self-

explanatory because you may not be there to explain it. Highly

specialized jargon, abbreviations and personal notation codes should

be avoided.

HA.com has a free feature called

MyCollection

™

which allows the

collector to keep a private record. For

coin and comic collectors, the feature

is particularly useful because you will

be able to quickly see market values

for your pieces. HA.com/MyCollection

5

Different types of collectible property require different information fields,

but a general checklist might appear as follows:

• Object type: What is it?

• Title: Does it have a known or descriptive title?

• Maker: Is the creator known?

• Medium: What’s it made of?

• Size: Dimensions and/or weight?

• Inscriptions: Is anything written on it?

• Signature: Did the maker sign it? Where and how?

• Subject: Is there a representation on the item?

• Date: When was it made?

• Manner of Acquisition: How did you obtain it? (Auction,

yard sale, etc.)

• Cost/Date of Acquisition: What did you pay for it? When

did you buy it?

• Location: Where is the item? A safe deposit box, file cabinet, on loan to

local museum? Specifics are important; if it’s in a binder, say where the

binder is located. For example, if a painting is in the living room above

the sofa, note the location and the date the information was entered.

• Provenance: What is the item’s history of ownership?

• Special Notes: Anything else you would want an heir to know

about it? More information is always better. For example, has it been

exhibited or published in a catalog?

• Photographs: Take a picture of each item in your collection.

• File Folder: Keep or scan copies of all relevant documentation:

invoices, auction catalog entries, bills of lading, etc.

• Inventory Number: See next page.

6

The Art of Inventory Control: Tying it all Together

Even the most accurate inventory documentation can end up useless

if it is not “tied” to actual objects. Tying data to an object involves

giving each item a unique inventory number with which it is tagged or

marked, and then cross-referencing that tag with the written inventory

entry and a photograph.

A useful collection inventory number system should begin with the year

of acquisition, followed by an individual item number. For instance,

2016.001 would be reserved for the first piece acquired in the year

2016. This is the inventorying system used by museums, and with good

reason, since it is both predictable and easy to follow.

Tiffany Studios Leaded Glass and Gilt Bronze

Drophead Dragonfly Table Lamp, circa 1910.

Sold for $275,000 | April 2022

Property from the Collection of Jeep & Carla Harned

7

It is critical that the object, photograph, number tag and master

inventory do not become separated. String tags and sticker labels

often are used when safe to apply, and they can be removed easily;

of course, this is easier with some objects than others. Museums

generally look for a part of the object that is out of sight when on

display — usually the bottom or back — and put a small strip of varnish

down. After it dries, the ID number is written in ink, and when that

dries, another coat of varnish is placed over the number. For paintings,

only the back stretchers or frames should be marked with the work’s

unique ID number. Each type of property presents its own numbering

challenges. Often, the only solution is to tag the box or plastic sleeve

in which an object is stored, but this is not ideal since boxes and

sleeves can be switched. Today, bar code technology, microchips and

even radioactive isotope staining have enhanced our tagging options.

Do your research to see what’s out there and what’s best for your

particular collection. Ask dealers who specialize in the category, and

seek out the advice of societies that serve collectors. Find out what the

best practices are for each category you collect. A key principle is that

a tagging or numbering system should never damage an item.

When photographing an object, write its unique ID number on a piece

of paper and place it in the picture field so that the photograph actually

displays the object and the number. That way, any loose photograph

can be easily identified. Most large collections contain near-identical or

duplicate items that, to the untrained eye, may appear indistinguishable

from one another, even though values can vary widely. Many coin

collections have been spent by heirs who were unaware that the coins

had value to collectors, and this fate could be avoided with proper

identification.

You will thank yourself in the long run, as will everyone involved!

Finally, maintain a second copy of your complete inventory, including

photographs, in a different location from the collection itself. Safe

deposit boxes in banks are recommended, and it also is a good idea to

have an electronic copy stored on a backup disc and/or online.

When you sell or otherwise remove an item from your collection, make

certain that it is noted clearly in your inventory—unless, of course, you

despise your heirs and wish to send them on a decades-long hunt for

a valuable object you sold 20 years ago.

8

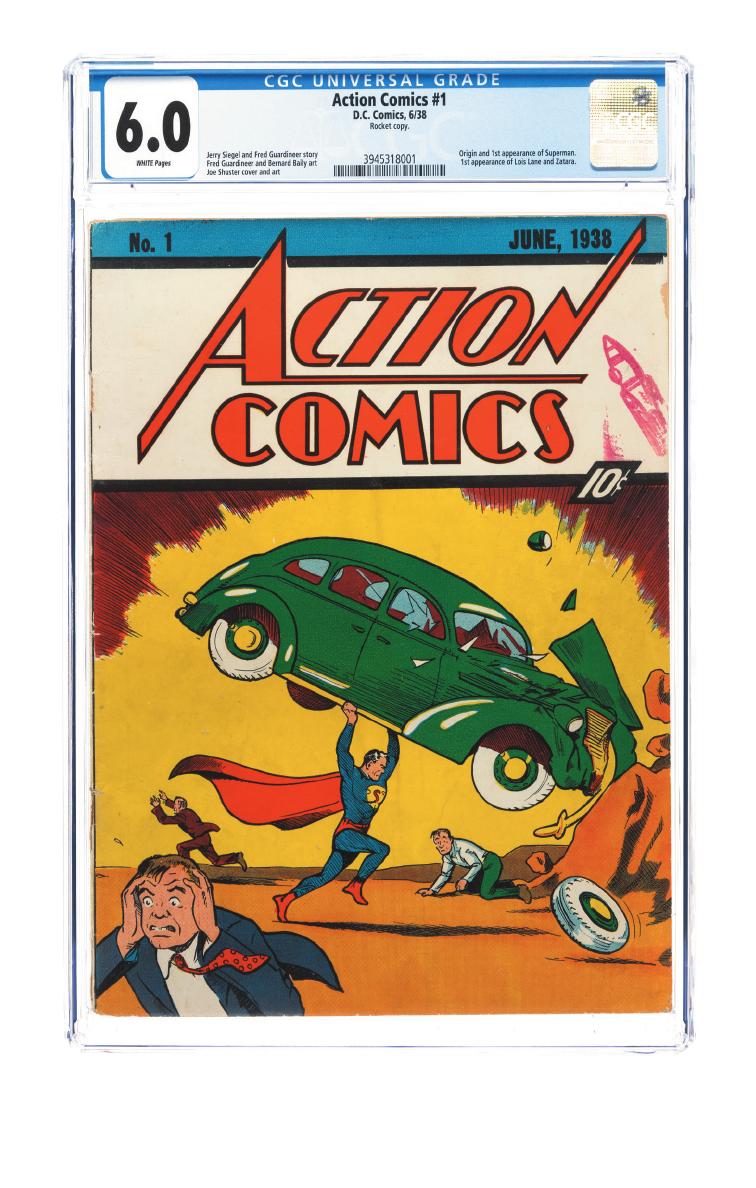

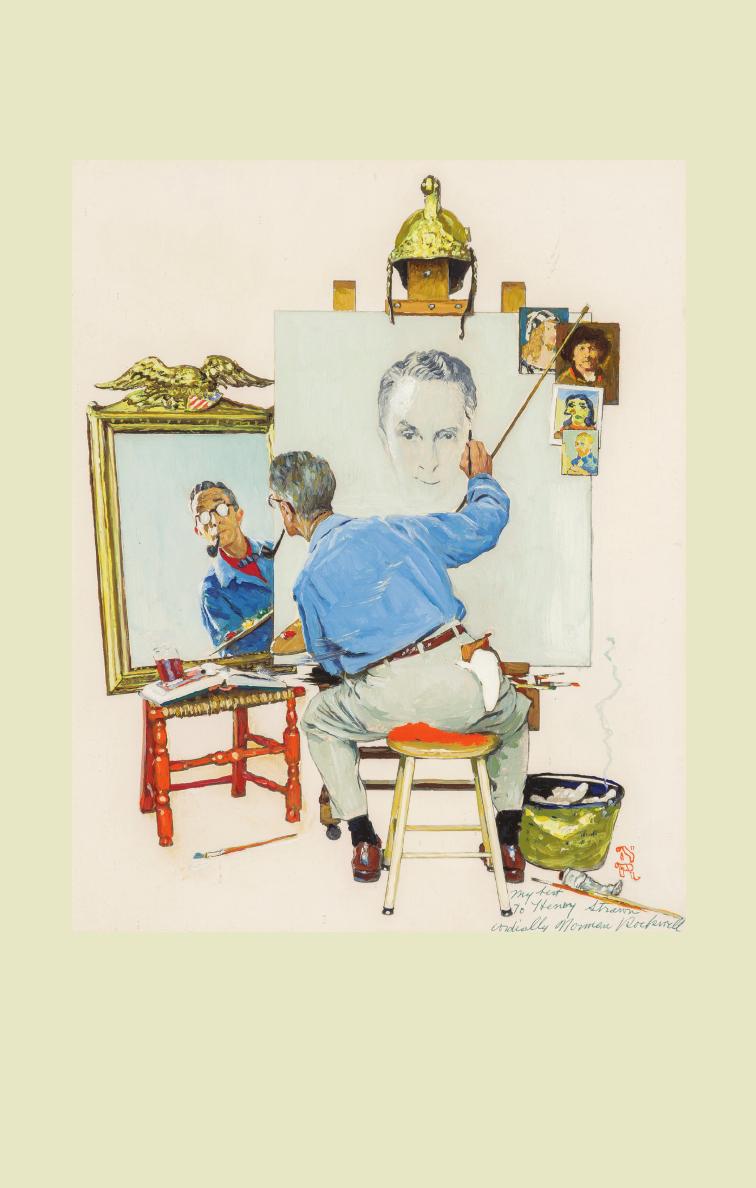

Norman Rockwell (American, 1894-1978) Home for

Thanksgiving, The Saturday Evening Post cover,

November 24, 1945

Sold for $4,305,000 | November 2021

Property from the E.M. Connor Post #193 American Legion,

Winchendon, Massachusetts, Being Sold To Benefit

Operational and Building Funds

9

2

Caring For Your Collection

“He that thinks he can afford to be negligent is not far

from being poor.” – Samuel Johnson

“Never neglect details.” – Colin Powell

A

fter being created, all objects age; they act and react over time in

accordance with their physical and chemical properties, combined

with the environment in which they’re stored. Metals mineralize naturally.

Paper collectibles are photo-chemically changed when exposed to

the light necessary for us to enjoy them. Soft fabrics become brittle

and hard substances become pliable. While some changes may take

centuries, others take only minutes — and the goal of the collector, like

that of the museum conservator or a Hollywood actor, should be to

minimize damage and slow the aging process.

Human contact is the leading culprit of wear and deterioration. Use of

an object, whether it is a circulated coin or toy train, takes a toll. For

many items, use reduces value, but in others, it increases it. A baseball

glove worn out by 10 years of continued use by Ted Williams has

greater value because of its history, regardless of the physical condition

that results from aging. For baseball cards, part of the value comes

from their ability to withstand the long odds of survival: cards cut from

recently discovered sheets are seen as second-class citizens. Each

category of collectible has its own standard that governs the effects of

original use on value. Once an object has left its original environment

and becomes a cultural collectible, the new owners must endeavor to

preserve its condition.

Human touch can harm objects physically and chemically through

the acids in perspiration. After that, sunlight and moisture are the

two greatest destroyers of most collections. Another serious threat is

contact with reactive materials such as a cleansing or sealing agent.

10

Human Contact

Avoiding direct contact with objects, if possible, is best.

• Coins can be placed in sealed inert capsules, which protect

them from both physical and chemical harm. If outside a capsule,

a coin should only be grasped by its edge, avoiding contact with

its two sides. Paintings should be framed using archival materials;

prints should be glazed, then framed. Grasp only the frames

when examining. Comics should be placed in Mylar sleeves or

encapsulated by Certified Guaranty Company (CGC).

• White cotton gloves should be worn when handling anything

directly, but be aware that your grip may be affected by wearing

gloves. When examining a valuable ceramic lidded jar, place

one hand on the lid and the other under the base, so that the

lid does not fall off while being moved. Statues in any medium

should never be grasped by their extending parts (for instance,

the arms or legs of figural works).

Sunlight and Artificial Light

If you have ever noticed a rich dark mahogany table bleached off-white

and cracked because of its location near a window, or a once-vibrant

watercolor painting that has faded dramatically, you have witnessed the

powerful effect of light on objects. Prolonged exposure to ultraviolet light

may destroy valuable furniture, paintings, photographs, books

and textiles.

If you wish to keep your collections in plain view, certain steps should

be taken to minimize light damage:

• Purchase windows that filter UV light.

• Place UV filter sleeves over fluorescent lighting.

• Glaze framed items with UV filtering acrylic, not glass (not

appropriate for all media).

• Hang curtains and blinds to filter sunlight.

• Never position a light-sensitive object in direct sunlight.

• Keep sensitive works covered with protective cloth; remove only

when viewing.

11

1909 T206 Sweet Caporal

Honus Wagner

(The Garagiola Wagner)

SGC Authentic.

Sold for $2,520,000

February 2021

12

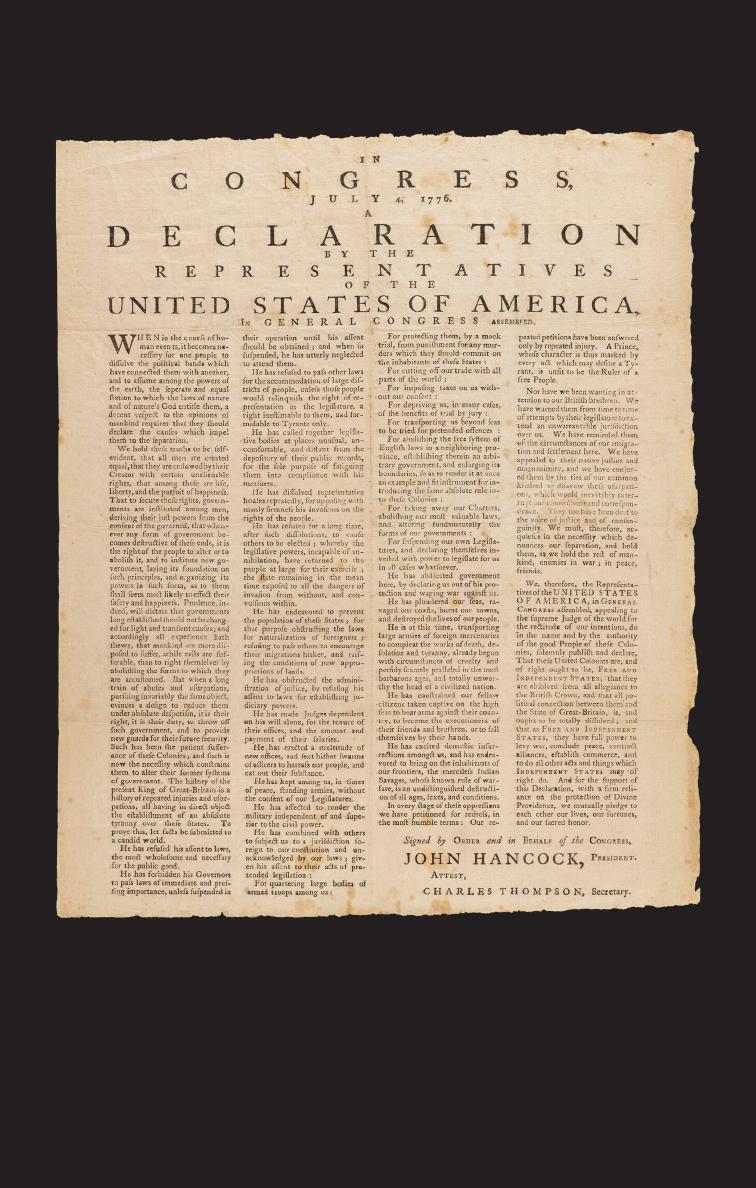

[DECLARATION OF INDEPENDENCE]. Folio

broadside, [Salem, MA: Ezekiel Russell

(or John Rogers at Russell’s printing office),

circa July 14-16, 1776].

Sold for $2,895,000 | July 2023

13

Water and Moisture

“For my birthday I got a humidifier and a dehumidifier. I put

them in the same room and let them fight it out.” – Steven Wright

Most water damage is caused not by rain, burst pipes or floods, but by

humidity. Organic materials deteriorate in humid conditions; mold and

mildew can grow, and metals mineralize at a faster rate.

The recommended relative humidity (RH) for your collections should be

determined (check with a dealer or society that specializes in your field),

after which you need to take the necessary steps to protect your collections

from air conditioning, humidifying and dehumidifying. It is important to avoid

large fluctuations in RH and temperature, as these fluctuations may cause

serious stress to any object. Here are the recommended storage conditions

for a few of our most popular categories:

• Books: 68°F to 72°F, with 40 to 50 percent relative humidity.

• Comic Books: 50°F to 65°F — and it’s important to keep the

temperature consistent. 40 to 60 percent relative humidity is

recommended.

• Coins (and other metals): The biggest concern here is relative

humidity. Below 30 percent is ideal.

• Historic Paper: The Preservation Directorate at The Library

of Congress says it stores documents at 50°F with relative

humidity of 50 percent.

• Paintings: 68°F is recommended, with relatively humidity at

around 50 percent.

• Stamps: 65°F and 50 percent relative humidity is the

recommendation from Linn’s Stamp News.

Reactive Materials

It is not unusual to find 19th-century prints on pulp paper in their original

frames, with acid-rich mats fixed with glued tape, backed by thin planks

of pine and secured with iron-alloy nails. We since have learned a great

deal about reactive chemistry and understand that the old practices are

truly bad.

The acid in the mat leaks out to the print, causing discoloration or

mat burn. Other acids in the adhesive tape do the same. The wood

14

Retro Raymond Yard Citrine,

Gold Jewelry Suite

Sold for $250,000 | May 2022

Property from the Cary M. Maguire Estate, Dallas, Texas

This suite was

commissioned by Joan

Crawford from famed

jeweler Raymond Yard. After

receiving it, she wore it in

the film Where Ladies Meet

(1941) and in a print ad for

Royal Crown Cola.

15

backer and frame, which are designed to protect the print, are full of

acetic acid, formic acid, formaldehyde and other chemicals that can do

serious damage. Finally, the iron nails reacting to the wood and moist air

corrode quickly, harming anything in close proximity.

Today, even our urban, industrialized air contains sulfur dioxide and

nitrogen dioxide that can create an acidic environment in the presence

of elevated relative humidity.

It is imperative that collectors learn what conditions will affect their

particular collections. Outdoor marble statuary will not be harmed

greatly by sunlight or termites, but acid rain will do the job quickly unless

a protective wax is applied regularly. Some modern art is created with

materials that are meant to change over time, and that change is part of

the artist’s intention. Every category of art, antiques and collectibles has

its own preservation requirements.

Educate Yourself

Don’t assume the frames, wrappers, backboards, plastic sleeves or

other materials that house your artworks or collectibles at the time of

purchase are the safest ones available for the continued health of your

acquisitions. The fact that many collectibles have appreciated in value

over time means that a costlier means of preservation may be more

justified today than when an item originally was sold.

Caring for your collection properly requires learning the safest and most

updated methods available for viewing, displaying and storing items.

Each object will have unique issues relevant to its own material, form

and condition.

Museum and conservation information is readily available in books

and online. A good reference is Conservation Concerns: A Guide for

Collectors and Curators, edited by Konstanze Bachman. For more

advice on issues surrounding storage and preservation, check with

reputable dealers, auctioneers, and collectors’ societies.

16

Most collectors get to a point at which they decide to downsize, and this

includes celebrities. Celebrity connections have the ability to increase

the value of otherwise ordinary items. Sylvester Stallone called Heritage

Auctions when he decided to sell items from his personal collection that

spanned his long career in Hollywood.

Stallone wanted to be part of the sales process and stayed through

several hours of the first day’s bidding, interacting with fans and posing

for pictures. “The memorabilia I have has been used and been a part of

my life for — kind of hard to admit this— well over 40 years,” Stallone

said. “It has been in my possession and I have fond memories attached

to just about every object. There comes a point, though, when I think that

I’ve used these objects enough and have created enough memories that

I can let them go.”

Heritage’s sale, titled “Stallone – The Auction” took place Dec. 18-20,

2015, and included dozens of his most iconic costumes, props and

personal items. Some of the items included the leather jacket that

Stallone wore as a costume in the first Rocky movie in 1976, which

doubled its estimate when it sold for $149,000. On the jacket, Stallone

reminisced, “I remember when I bought this jacket. It was obviously quite

a few years before I ever even thought about Rocky, before Rocky was

even an idea. This is what I would wear in my everyday life, and when

the time came to do the movie, we didn’t have a budget where we could

afford an original wardrobe so I thought, ‘Why don’t I just wear the things

that I think Rocky would wear, clothes from my real life?’ So, I went in

my closet, pulled out this jacket. It’s one of those unique times where life

imitates art, art imitates reality. This jacket was used in several of the films

and it really established Rocky as kind of mythical, dark knight character.

You knew something special was going to happen with this individual

because he just looked different — and this black leather jacket set the

tone for the rest of the series.”

A used leather jacket that would be worth perhaps $30 in a secondhand

store, described in the auction catalog as a “Small collar, five button front

closure, two front pockets, two distinct pleats at shoulders, black faux

Star Power

The Auction

Stallone

17

fur zip-out lining,” became worth nearly $150,000 due to its connection

to a great actor and a classic film. Stallone helped Heritage in crafting

the lot descriptions, adding priceless first-hand anecdotes that likely

encouraged the robust bidding. In total, 13 bidders competed for the lot,

with the winning bid being placed online at HA Live.

The Stallone sale realized more than $3 million. Beyond sharing his

personal history with thousands of fans, Stallone donated a portion of the

proceeds to various charities that assist military veterans and wounded

servicemen and servicewomen as well as The Motion Picture and TV

Country House and Hospital.

A Sylvester Stallone

Personal Black Leather

Jacket from “Rocky.”

Sold for $149,000 | December 2015

Stallone

18

Mary Anne Sammons Cree

The Estate Gift of

Fancy Intense Yellow Diamond Ring

Sold for $591,000

D

allas, Texas native Mary Anne Sammons Cree quietly and powerfully

supported many passions during her lifetime, often focusing on

opportunities for her community to experience the wonder of the

arts and the natural world. So generous was Cree that even after her

passing, she continued to give back to her beloved hometown.

In September 2022, Heritage Auctions offered more than 125 pieces

from Cree’s extraordinary jewelry collection as the centerpiece of our

Fall Fine Jewelry Signature

®

Auction. Proceeds from the sale of Cree’s

jewelry supported The Rosine Fund of Communities Foundation of

Texas, so named for Mary Anne’s mother, from whom she inherited her

spirit of giving.

“As a Dallas-based auction house, it was kismet for Heritage Auctions

to partner with Communities Foundation of Texas to present Mary

Anne’s stunning jewelry collection to collectors worldwide,” says Michelle

Castro, Vice President of Trusts & Estates.

19

David Webb Jewelry Suite

Sold for $47,500

Fancy Yellow Diamond Earrings

Sold for $225,000

20

1787 DBLN New York-Style Brasher

Doubloon, EB on Wing,

MS65★ NGC. CAC. W-5840.

Sold for $9,360,000 | January 2021

21

3

Safeguarding Your Collection

“If you didn’t have so much stuff, you wouldn’t need a

house. You could just walk around all the time. A house is

just a pile of stuff with a cover on it.” – George Carlin

C

rimes against property are on the rise, and the reasons that

fine art, antiques and collectibles are great investments are the

same reasons they’re great targets for thieves. The current arrest and

conviction rate is abysmal, and the odds of recovering stolen goods

are even lower. With budget constraints forcing law enforcement to

deprioritize property crimes, the outlook for a reversal in that trend

is not good. The only solution is to do what you can to protect your

collection against criminals — and make sure that it is properly insured

in the event that you are the victim of a crime (or natural disaster).

Security vs. Access

Most collectors want their treasures close at hand to study and enjoy

— even though that is a suboptimal loss prevention strategy.

To alleviate this, write your own personal security plan and include

these elements:

• Security

Your collection is at risk from theft, fire, water damage and other

natural disasters. If you are going to have objects of substantial value

at your residence, you should consider several proactive measures

to protect them.

• Monitored Security System

A monitored system is at the core of any security plan. This

includes both theft and fire alarms that are monitored externally

and immediately reported directly to police and fire departments

when triggered. Hardware can be installed for a few hundred to a

few thousand dollars, and monitoring involves a monthly expense,

22

currently around $25 to $75. A monitored security system sends

most burglars looking for easier targets and puts the more daring

ones on the clock. Once the system perimeter is breached, the

burglar has only the response time to grab what he can and attempt

an escape. This might seem like a pain and a substantial investment,

but there are advantages. According to the Insurance Information

Institute, the average homeowner’s insurance discount provided

based on the presence of a monitored security system is between

15 and 20 percent; according to the Electronic Security Association,

the average loss on a home with a system is $3,266, compared

with $5,343 for an unprotected home. But wait! There’s more!

You’ll also be protecting your neighborhood as a whole: A 2009

study out of the School of Criminal Justice at Rutgers University

found that the higher the percentage of homes in a neighborhood

that have security systems, the fewer break-ins occur in that

neighborhood — providing a benefit even to residents who don’t

have a security system.

• Home Safe

A safe can be an excellent way to protect valuables and important

documents from theft or damage, but choosing one that meets your

needs can be challenging. Safes are rated on their burglary and fire

resistance. Some safes offer significant protection against burglary

but offer no fire protection. Others may be able to withstand heat for

hours but are not rated against attacks from power tools.

The cost of a safe is primarily a function of its protection ratings

and size. The larger a safe is and the more protection it offers, the

more expensive it will be. Additionally, insurance companies may

have specific requirements for a home safe. A reputable safe dealer

should be able to help you select a model that meets your budget,

protection needs, physical space, and any applicable insurance

requirements.

• Deterrent Practices

There are other actions that reduce the risk of a successful burglary.

Always leave the impression that someone is at home. This can be

accomplished in part by remembering to have your paper and mail

held while you are out of town and by placing one or more of your

lights on timers. “Beware of Dog” signs are helpful in warding off

potential burglars and also can reduce your Halloween expenditures.

23

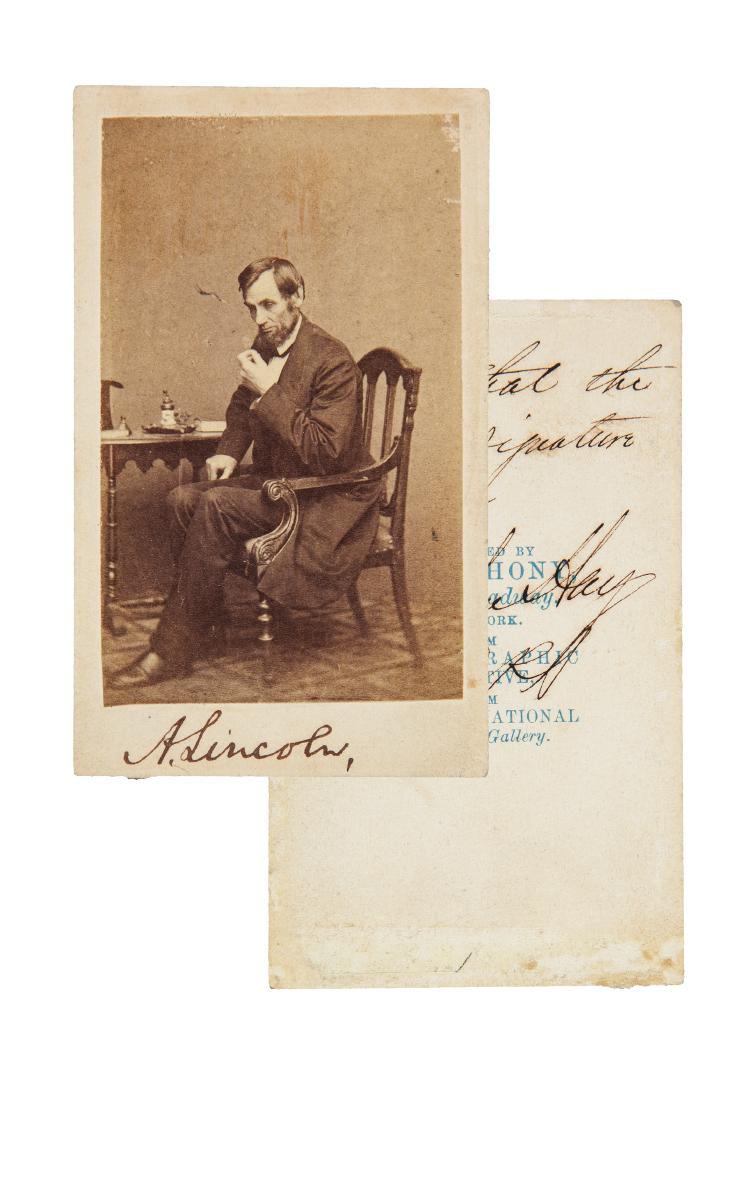

Abraham Lincoln: Outstanding

Signed Carte-de-Visite.

Sold for $175,000 | September 2016

24

• Camouflaging Valuables

Most people are predictable, and experienced burglars know all the

“good” hiding places. Typically, most people keep their valuables

in the master bedroom and home office. Guess where burglars go

first? So, try to avoid these typical hiding spots and leave decoys.

One gentleman we know has numerous coin albums (filled with

pocket change) in plain sight on the bookshelves. Another has an

old safe that is heavy but moveable. It resides in the corner of his

home office and contains absolutely nothing. Its predecessor was

removed in a burglary during which the thief left behind several

thousand dollars’ worth of electronics because he thought the

safe was the jackpot. He now has a monitored security system

and modern wall safe, but still keeps a decoy as a reminder of the

importance of security and the burglar who was the recipient of

nothing but an empty box (and perhaps a hernia). If you don’t own a

safe, small valuables are best hidden in a false outlet with an object

plugged into it. A collection of small items should be spread over

several non-obvious locations.

Off-Site Storage & Transport

The primary off-site storage option is a safe deposit box at either

a bank or private vault. If you can find a location close to home

or work, the inconvenience factor can be minimized. Sites with

weekend access offer a major advantage. Remember that while safe

deposit boxes offer secure storage, vigilance is still important. Here

are a few storage and security guidelines you need to remember

and follow:

• Rent a box that is large enough to hold everything easily.

• Use a desiccant such as silica gel to remove any moisture, and

change it regularly.

• Never forget that your greatest security danger is in transporting the

collectibles to and from the box. Use a nondescript container to hold

them, and try not to carry too much weight at once.

• Have someone drive you to the location, or, if you must drive

yourself, park as close to the entrance as possible to minimize your

time on the street with the valuables.

•

Avoid establishing a pattern in picking up or dropping off your collection.

25

• Be aware of your surroundings when transporting your collectibles.

Check your rearview mirror frequently, and if you believe you’re being

followed, do not drive directly to your destination. Make several

detours that do not follow any logical traffic pattern and see if you

are able to lose the suspect vehicle. Know the location of the closest

police station, and if you can’t lose your stalker, drive there directly.

We know this sounds a little like a made-for-TV movie, but

it’s important.

• Carry a cell phone with you when transporting valuables. A

frightening robbery technique is to rear-end a vehicle and then rob

the driver when he or she exits to assess the damage and exchange

insurance information. You will have to use your judgment in this

situation, but if you are carrying valuables and are rear-ended,

you should remain in the car and call 911. Don’t hesitate to tell the

operator that you are carrying valuables and are concerned about the

possibility of robbery. If you really believe that it is a setup, don’t stop

— call 911 and explain the situation while driving to the police station.

With their steady flow of people, noise and confusion, airports have

also become a favorite hub for thieves. The usual method is the

snatch-and-grab; the thief targets someone who appears distracted,

grabs the briefcase or bag and melts into the crowd.

A variation is the use of teams of criminals located where baggage is

being unloaded at the curb. A few of the thieves distract the victim while

others grab the bags, after

which all of them make their

escape in a waiting vehicle.

Hermès Extraordinary 30cm Matte

White Himalayan Niloticus Crocodile

Birkin Bag with Palladium Hardware.

Sold for $140,000 | September 2021

26

Your only protection is constant vigilance. You should always either

have a grip or your foot on any case containing valuables.

Some people carry a loud whistle when transporting valuables. If

someone attempts to grab a bag and you start blowing the whistle, the

thief is put on the defensive. Everyone else in the area is confused or

startled by the noise and the thief loses the camouflage of the crowd.

Shipping

First and foremost, do not attach anything to the outside of the

package that would hint at its contents. When Ty Inc., the company

behind Beanie Babies, realized that boxes were being lost during

shipping in huge quantities at the height of that mania, it made a

simple change by removing its logo from the boxes. Consequently,

theft shrank dramatically. If a package contains any identifying words,

such as “coins,” in the mailing address or on the outer wrapping, it

makes the contents of that package more appealing to thieves.

Pack the items securely so that they do not rattle. Loose spaces

(such as in tubes) should be filled. Styrofoam “peanuts” are good for

this purpose. Make sure that your shipping box is strong enough for

the included weight, then bind it with strapping tape. If you are using

Registered Mail (the preferred method for most collectors to ship small

packages containing valuable items), the Post Office has a requirement

that all access seams be sealed with an approved paper tape.

Including the word “fragile” in large letters on the package may prevent

rough handling by carriers.

Method of shipment involves a decision that weighs value, risk and

cost. USPS First Class or Priority Mail with insurance is the most

cost-effective method for packages up to $500 in value. The rate of

loss has dropped considerably over the last decade, making this

a reasonable option for inexpensive items that can be replaced.

Above the $500 value, Registered Mail with Postal Insurance is

both cost-effective and extremely safe. The one caveat is that the

insurance maximum for registered mail is $50,000. The Post Office

requires you to indicate if the contents exceed that amount but it

will not pay more than $50,000 on a claim. If the value exceeds

that amount, you will need to send multiple packages or obtain

supplemental private insurance.

27

FedEx, UPS and other private shippers have become popular in recent

years, offering fast, guaranteed delivery with a high success rate. They

also offer some insurance options, but rare coins and certain other

collectibles are specifically excluded. You will need to obtain private

insurance coverage if you use one of these shippers, or you may

request that the other party insures the shipment if there is sufficient

coverage available and a shipper account.

Insurance

No matter how many security measures you employ to protect your

collection, you will also need to acquire suitable insurance to protect

yourself. This can be a complicated area, as insurance companies

write policies in a language all their own. As a collector, you need to

be especially mindful of homeowner’s insurance because you likely will

require a policy that differs from a standard one.

A Tiffany & Co. Partial Gilt Silver Punch Bowl and Ladle Driving Trophy, New York, 1881

Sold for $118,750 | November 2020

American Presentation and Trophy Silver from the Collection of J.D. Parks

28

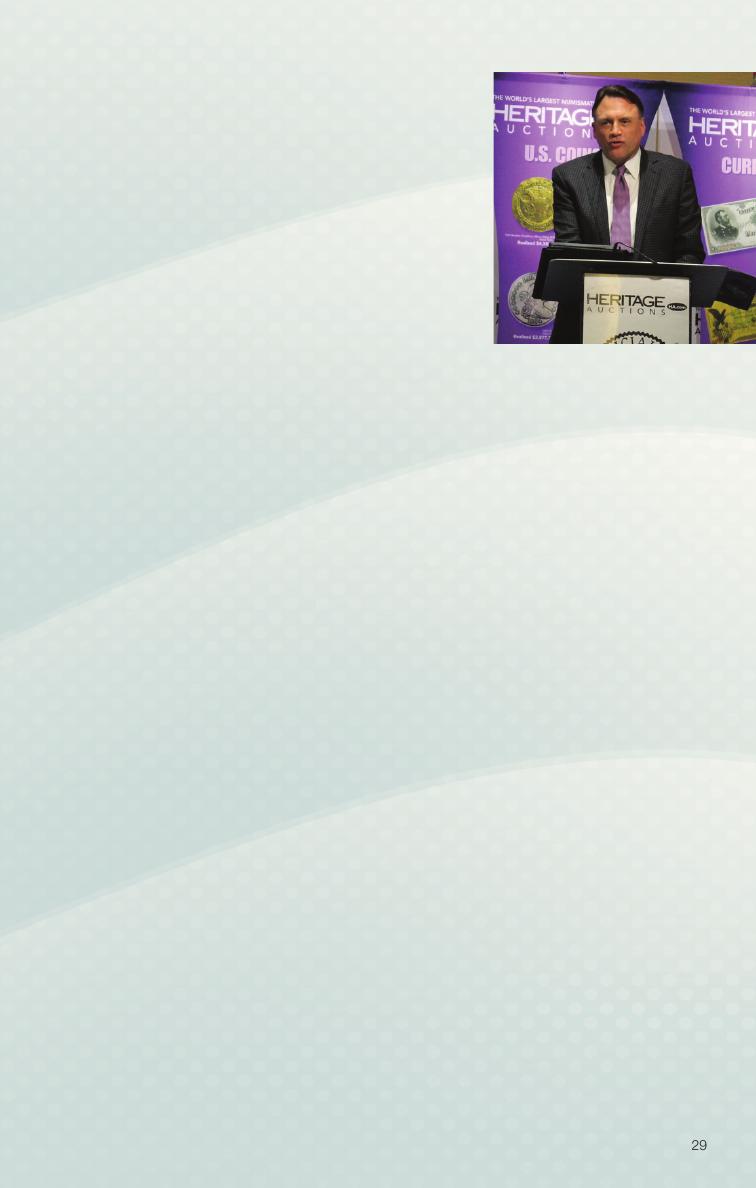

Coins hidden in fake plumbing and stored in a bank box that likely

hadn’t been opened in nearly a century were two of the tales Heritage

Auctions President Greg Rohan told collectors attending his presentation

on “Major Collections We’ve Auctioned – The Back Story” at the Central

States convention.

After Jules Reiver, noted collector, researcher and writer, died in 2004 at

87, his family contracted with another dealer to sell his collection. Rohan

said, “We were brought in. I went out to their house. It was a very modest

house. I had been there before, and I remembered that Jules had to go

under the kitchen sink to get coins out. He had them in fake pipes under

the sink. So we got the coins that were at the house and went to the bank

and got the coins that were at the bank.”

Reiver’s wife, Iona, who died in 2017 at 97, said her husband had always

said his collection was worth $1 million. Heritage estimated it would bring

$6 million to $7 million, a figure, Rohan said, he thought the family took

with a grain of salt. The collection sold for more than $8 million. After the

collection was sold, Rohan said Mrs. Reiver told him, “I feel just like the

Beverly Hillbillies.”

In 2015, Rohan said, Heritage was contacted by an art auction house

about a coin collection that had been put together between 1850 and

1930 by the Rev. James G .K. McClure, pastor of First Presbyterian

Church in Lake Forest, Ill., for 25 years. The coins, housed in custom

cases, had sat largely untouched in a bank safe deposit box since

McClure’s death in 1932. “Boy, did that get my attention,” Rohan said.

“To see the coins that had been untouched since that time was one of

the most extraordinary experiences.”

The collection was notable for its depth, state of preservation and the way

it was accumulated. Rohan said, “Rev. McClure got coins at a face value

at the bank. There were a few times where there were coins that were

harder to get, proof coins that he got as gifts from parishioners. He paid

maybe a few dollars for some.

“Seeing his Walking Liberty halves, all of which he got at the bank at

the time of circulation – the 1921, ‘21-D, ‘21-S. These coins were of

Nearly Century-Old Safe Box

Coins Stored in Fake Plumbing,

29

Nearly Century-Old Safe Box

unbelievable quality, unbelievable. ... I would

look at rows of coins that were taken out of

circulation that were worth just a few dollars

each and then come to one that was worth a

hundred thousand dollars.”

He said a Chicago-area coin dealer had offered

the family $840,000 for the collection. “Being

intelligent and prudent people, they decided to

get another opinion,” he said. “Our estimate was

$3 million to 3.5 million.” The collection sold for

$4.5 million at auction in 2016.

The Gene Gardner collection, another collection

Heritage handled, sold for $52.8 million in four sales in 2014 and 2015.

Rohan, who developed a personal friendship with Gardner before his

death in 2016 at age 80, said Eugene Herr Gardner Sr. was born to a

life of wealth and privilege. He had the wherewithal to build a notable

collection while still in college in the 1960s, but his hobby didn’t sit well

with his family.

Rohan said, Gardner’s “father was very upset with him for spending a

few hundred thousand dollars in the 1960s on coins and thought it was a

complete folly and a waste of money and that his son has lost his mind.

So Gene sold the collection after he graduated from college and ... it

brought $700,000.

“I think there was some ‘I told you so’s’ around the dinner table. I don’t

think Gene’s father ever questioned his business acumen ever again. He

turned out to be one of the great investors of our time.”

Gardner founded investment advisor Gardner Russo & Gardner, which,

Rohan said, had more than $10 billion under management.

Gardner was diagnosed with multiple myeloma in 2010 and given a short

time to live. At his wife’s request, preparations for the first auction were

speeded up so Gardner could witness the sale of some of his most-

prized coins. However, he lived to see the entire collection sold, dying a

few months after the last sale and six years after diagnosis.

This article was originally published in the Summer 2019 issue of the Central States Numismatic Society’s

journal, The Centinel, www.centralstatesnumismaticsociety.org. Reprinted with permission.

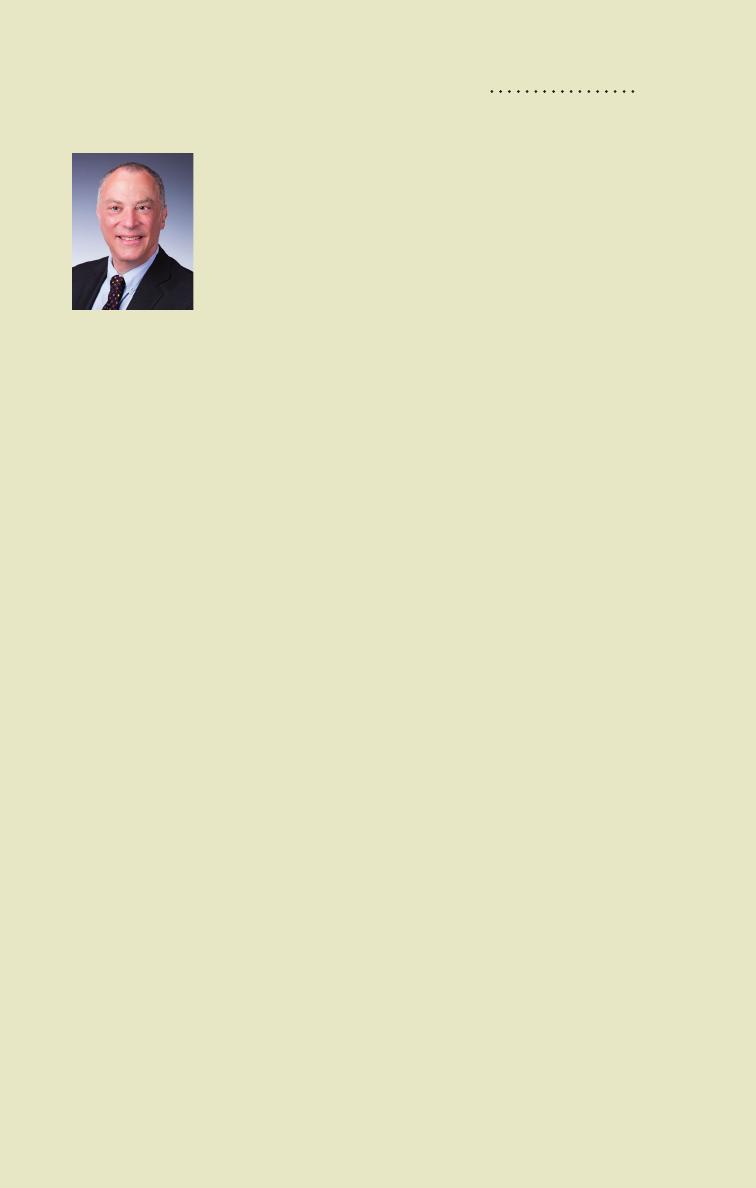

Heritage Auctions President

Greg Rohan addresses bidders

on Platinum Night.

30

As someone seeking protection, you need to understand that contract

language generally favors the insurance company, and you need to

know exactly what coverage you are — and are not — receiving. That

means asking questions and reading every word of every document in

every policy you sign. In the case of coins, you need to be particularly

certain of what coverage applies when the coins are at home, in

a safe-deposit box or in transit, as well as any additional security

requirements for each circumstance. Some things to keep in mind:

• Most homeowner’s policies DO NOT insure your coin or jewelry

collection beyond $1,000 (combined with all other items defined as

a “valuable”). Most insurance companies will offer a rider for more

specific coverage, but since it’s not their standard business, they

Auguste Rodin (French, 1840-1917)

Éternel printemps, deuxième état, première reduction, 1899-1901

Bronze with brown-black patina

25-7/8 x 33-1/4 x 15-3/4 inches

Sold for $762,500 | December 2018

31

typically are not very flexible. You will be required to provide a fixed

inventory, and modifying the coverage whenever you buy or sell items

from your collection will likely require a major paperwork effort.

• Some insurance companies require an “appraisal for insurance.”

If you choose a company that has this requirement, guidance is

available later in this book. In this specialized field, the best option

often comes from a company that is familiar with the needs of

collectors. We have listed several companies in Appendix B.

• In the case of collectibles other than coins, you may want to ask a

dealer to recommend a knowledgeable insurance company. Not all

insurance companies possess the expertise or coverage options

that collectors require. While premiums vary, price is not the only

consideration. Find an agent and a company with a good reputation

and expertise in the field of collectibles. You may have to pay a little

more, but it will be well worth the price if you ever have to submit a

significant claim.

• One final note about security: You need to be careful about

discussing your collection (and especially where you keep it) with

others. Enjoy your collection, but stay vigilant. A little paranoia could

save you hundreds of thousands of dollars.

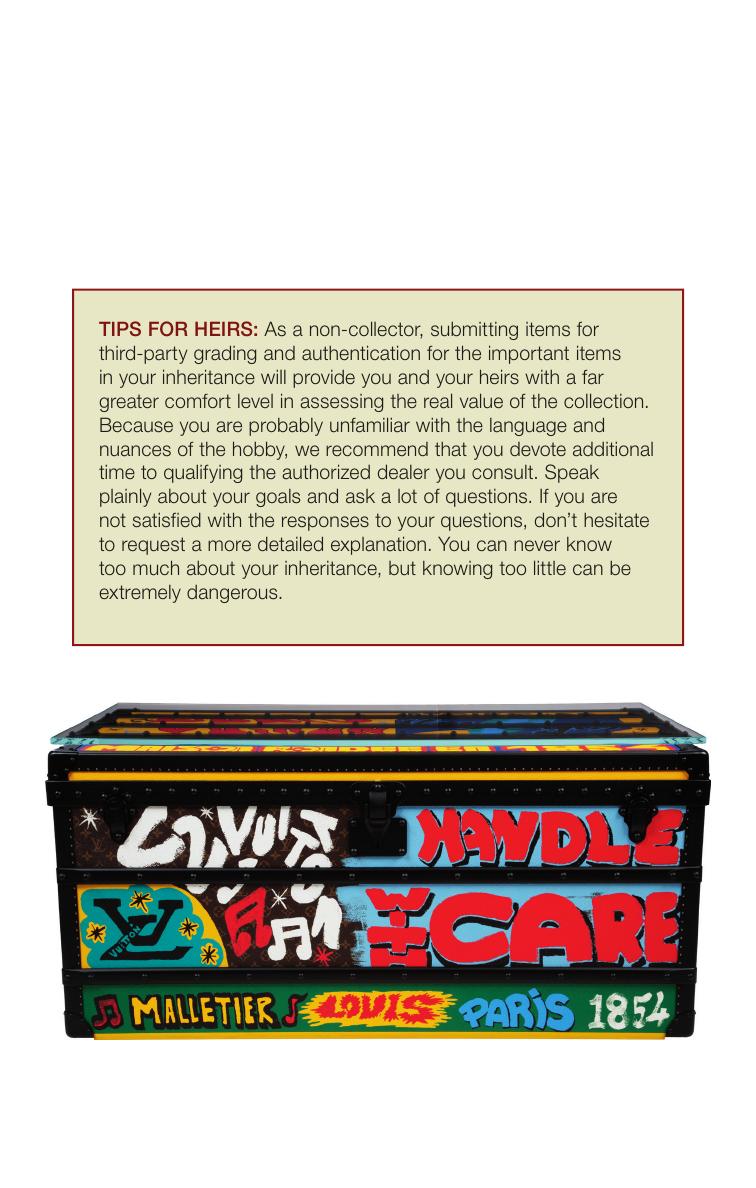

TIPS FOR HEIRS: This chapter contains advice that may be

the most important you will read. Seasoned collectors are

generally very security-conscious, but those who have come

into possession of a collection only recently must immediately

understand the risks and responsibilities that come with this

unfamiliar asset. If it’s small enough, take the collection to a safe

deposit box immediately. Until you have it safely transferred into

a bank vault, do not discuss it with others. With larger objects,

you may want to consult with an insurance agent about the best

method to safeguard them until they have found their next home.

32

Fancy Light Yellow Diamond, Diamond, Gold Ring

Sold for $324,500 | December 2017

33

Estate Planning For Your Collection

PART TWO

34

1794 $1 B-1, BB-1, R.4,

MS66+ PCGS. CAC

Sold for $6,600,000 | August 2021

Bob R. Simpson Collection

35

4

All in the Family

C

elebrities are just like us. Given their wealth, notoriety, and teams

of advisors, we expect celebrities to have formal estate plans in

place. Historically, it turns out that celebrities have more in common

with “us” and often do not have the appropriate documentation and

directives in place that will provide for their loved ones and secure their

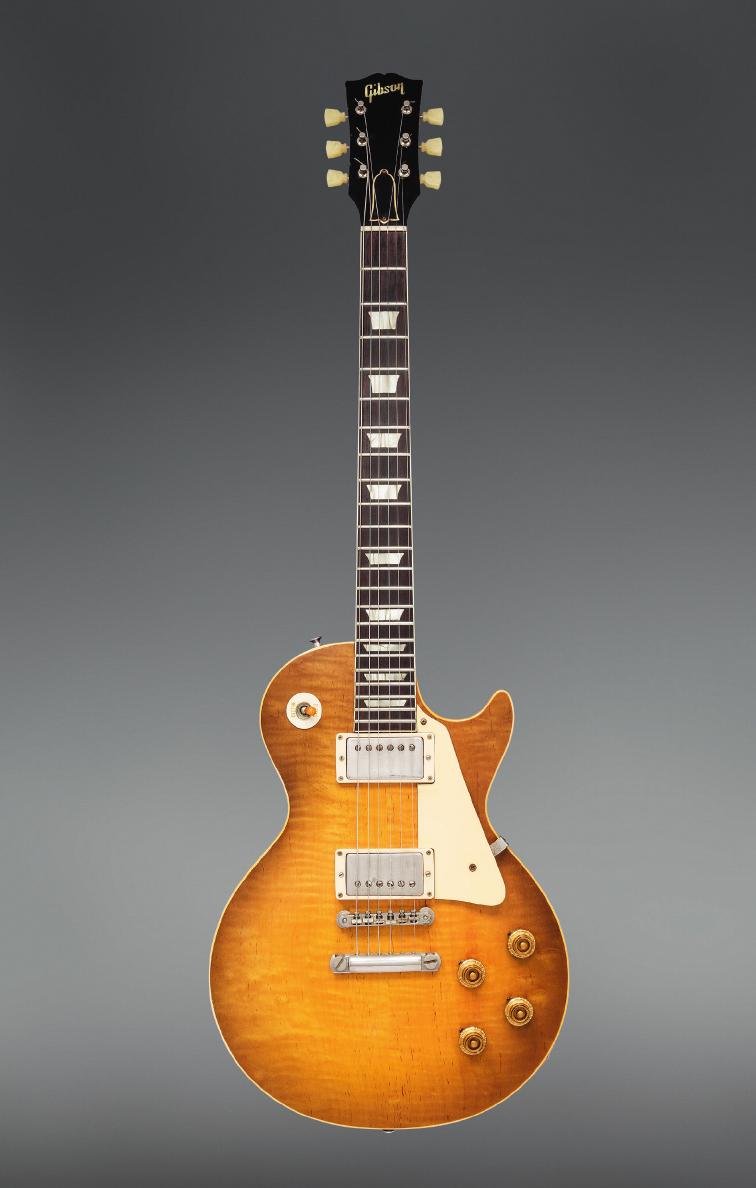

legacy once they are gone. Jimi Hendrix died in 1970, and his estate

was subsequently the subject of 30 years of litigation — a very un-rock

’n’ roll epilogue to an incredible career. Queen of Soul, Aretha Franklin’s

estate was involved in a long legal dispute over the singer’s two

handwritten wills, one in a locked cabinet and the other found in the

couch. Neither document was prepared by a lawyer or listed witnesses,

and both documents divided the singer’s assets differently. Ultimately,

a jury in Michigan probate court ruled that the handwritten document

found in the couch represented the singer’s true last wishes. Picasso

was revered as a business genius during his lifetime, but when he died

in 1973 without a proper will, his many heirs were thrust into chaos. It

took six years and a reported $30 million in expenses to divide up his

estate. More recently, musician Prince passed away in 2016 without

a will, leaving a sizeable estate hanging in limbo. Prince’s estate finally

settled in 2022 after a six-year court battle.

One recent survey found that over half of Americans with children do not

have a current estate plan. Most people try to avoid contemplating their

own demise, and many collectors are equally reluctant to consider the sale

of their treasures. As Woody Allen once told his physician, “Doctor, I’m not

afraid of dying, I just don’t want to be there when it happens.”

Heritage Auctions’ Trusts & Estates team assists professional

advisors, executors, fiduciaries, and beneficiaries with confidential

and comprehensive auction and formal appraisal services tailored to

the unique needs of the estate or collection. We recognize that each

client and appraisal project differs and often involves multi-category

collections and residences. Our Trusts & Estates specialists offer

complimentary walk-through services and bring together decades

of experience appraising property in over fifty collecting categories.

Beyond providing auction estimates for disposition purposes, our

36

team assists with providing cost estimates for appraisal projects for

charitable donations, gift taxes, loan collateral, and financial planning.

Heritage Auctions Appraisals Services, Inc. prepares appraisals for one

item or large, multi-category collections.

Headquartered in Dallas, Texas, and with offices in New York, Chicago,

Beverly Hills and Palm Beach, Heritage is well-positioned to work with

families and their advisors, providing creative solutions for estate planning

with collectibles. We understand this process can be overwhelming and

emotional; our goal at Heritage is to ensure a transparent and enjoyable

legacy- planning experience for you and your family.

Involve Your Family

Many collectors keep their families in the dark regarding scale and

nature of their collecting; there are many reasons for this, but consider

taking a longer view. Have you thought about the effect that your

sudden death or incapacitation might have on your collection? What

would you expect from your heirs? What should be done with your

collection? Should it be sold? Distributed among family members?

Some combination? What will remain after taxes?

One call from a surviving spouse took us to a house where we found

a dining room table covered with boxed world coins that were stacked

three feet high. From a distance, it was one of the most impressive

collections that we ever had inspected: all matching coin boxes, each

neatly labeled with its country of origin. The surviving spouse told us

that her husband had been a serious collector for more than three

decades, visiting his local coin shop nearly every Saturday. He then

came home and meticulously prepared his purchases, spending hour

upon happy hour at the table in his little study.

We opened the first box and couldn’t help but notice the neat, orderly

presentation: cardboard 2x2 coin holders, neatly stapled, with crisp

printing of country name, year of issue, Yeoman number, date of

purchase and amount paid. We also couldn’t help notice that

90 percent of the coins had been purchased for less than 50 cents

and the balance for less than $1 each. The collection contained box

after box of post-1940 minors — all impeccably presented and all

essentially worthless.

We asked the surviving spouse if she had any idea of the value of the

collection. She replied that she knew rare coins were valuable, and

37

The Very First Winchester Model 1876 1 of 100 Shipped

Historic Winchester “One of One-Hundred” Model 1876

Centennial Lever Action Rifle with Factory Letter

Sold for $615,000 | June 2023

38

John F. Kennedy. White House Rocking Chair gifted by the President to former New York

governor Averell Harriman.

Sold for $591,000 | May 2022

The Estate of Melvin “Pete” Mark, Jr.

39

since her late husband had worked so diligently on his collection for

so many years, she assumed that the proceeds would enable her to

afford a nice retirement in Florida.

We had to carefully explain that we couldn’t help her with the sale of

the coins. Her husband had enjoyed himself thoroughly for all those

years, but he had never told her that he was spending more on

holders, staples and boxes than he was on the coins. Her dreams of a

luxurious retirement diminished, we advised her to contact two dealers

who routinely purchase such coins. The fault was not in his collecting,

but in his failure to inform his wife of the nature of the collection

.

We more typically encounter surviving spouses and heirs at the other

end of the spectrum. When your spouse spends $50,000 or $100,000

on rare coins or other collectibles, you generally have some knowledge

of those purchases, but not always — and often, the most prodigious

collectors are coy with their family about just how much they’re

investing. This leads to the more enjoyable surprises — those made-

for-TV moments when we inform unsuspecting heirs of the vast fortune

they’ve inherited.

Years ago we encountered the younger of two sisters who were

dividing their father’s estate. He had left Germany in the early 1930s

— not a great time to immigrate to America, but an excellent time to

be leaving Germany. He brought to America two collections: antique

silver service pieces and his rare coins. The coins were sold mostly to

establish his business in Iowa. Despite the hard times, he prospered

and was able to devote the next 30 years to rebuilding his collection of

German coins.

At the same time, he continued to expand his collection of 17th-

and 18th-century German silverware. We knew every aspect of his

collecting history because he left a meticulous record on index cards.

Every coin and every piece of silver was detailed with his cataloging

and purchase history. His daughter was in awe of his passion for

maintaining such detailed records.

After his death, his daughters decided to split his collections between

themselves. They added up the purchase values of each of his

collections, which were just about equal. The older sister/executor

had acquired some small knowledge of antique silver, and since she

wished to keep all of the elegant heirloom tea service for herself,

she decided to keep the silver and give her younger sister the coins

40

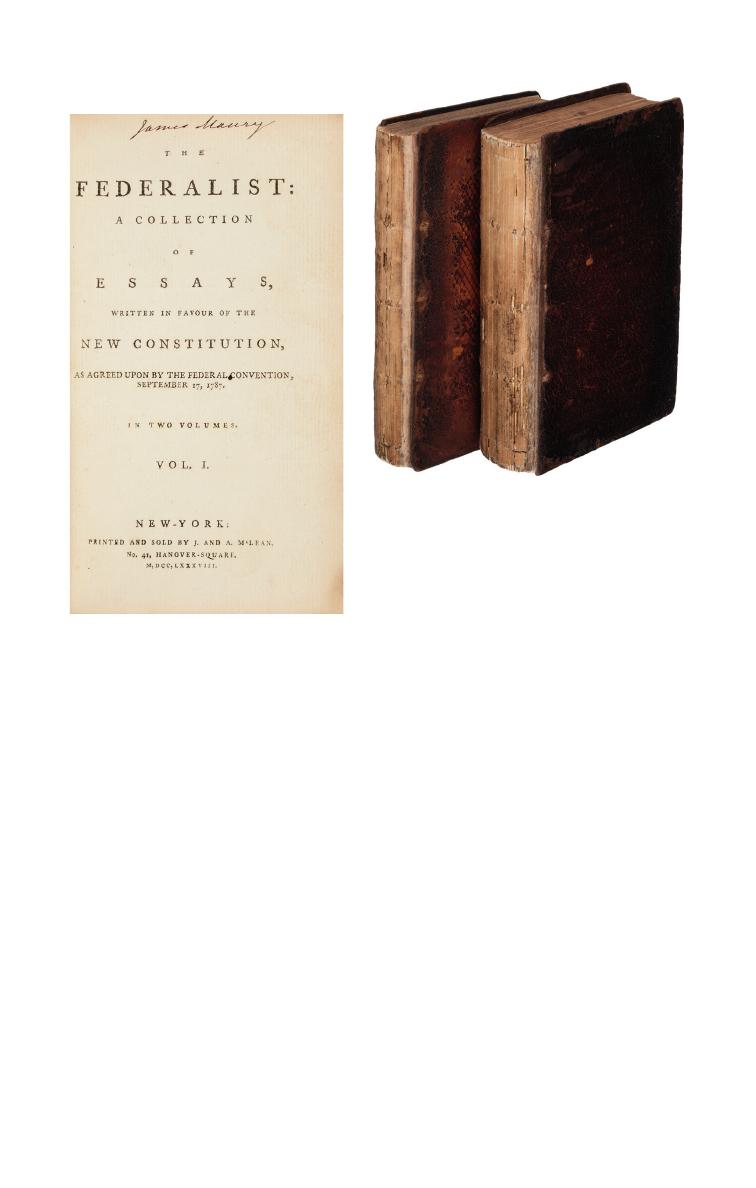

[Alexander Hamilton, James Madison, and John

Jay]. The Federalist: A Collection of Essays,

Written in Favour of the New Constitution,

as Agreed Upon by the Federal Convention,

September 17, 1787. New York: Printed and

Sold by J. and A. M’Lean, 1788.

Sold for $312,500 | March 2020

— she definitely was not interested in splitting. After selling the non-

family silver pieces through a regional auction house, she boasted of

realizing more than $200,000 from her father’s $27,000 investment.

The younger sister came to us with only one box of his coins. Her

father’s records for that box indicated a cost of less than $2,000, but

knowing the years he had collected, we were anticipating at least a few

nice coins. However, we were totally unprepared for what came next:

pristine coins of the greatest rarity. His $2,000 box was worth more

than $150,000, surpassing all our wildest expectations.

She then produced the record cards for the rest of the collection, and

we offered to travel back to Iowa with her the same day. When we

finished auctioning the coins, she had realized more than $1.2 million.

41

In another situation, the wife of a deceased coin dealer called us to

consign $1 million in rare coins from his estate. This asset represented

a significant portion of her retirement assets. We eagerly picked up the

coins, and already had started cataloging and photographing when we

received an urgent phone call from her attorney. The coins had to be

returned immediately. It appeared that her husband had been holding

the extensive coin purchases of his main customer in his vaults, and

he had neither informed his wife nor adequately marked the boxes.

Most of her $1 million retirement asset belonged to her husband’s

client and not to her husband.

A final example that really distressed us demonstrates that partial

planning, no matter how well intentioned, cannot always guarantee

the desired outcome. A collector with sizeable holdings divided his

coins equally (by value) between his adult son and daughter, with

instructions that they should seek expert advice before selling. After

the daughter came to us, she was pleased to learn that her coins

were worth in excess of $85,000.

Once she signed the Consignment Agreement, she told us the rest of

the story. Her brother had “sold” his share eight months earlier to a local

pawnbroker for less than $7,500. Her father hadn’t shared his knowledge

of the asset’s value with his children for fear that his son would spend the

money foolishly. Instead, her brother basically gave it away.

So, what should you do to prevent such problems?

If transferring your collection to the next generation is desirable, you

will want to provide for an orderly transition. If they aren’t interested in

sharing your love of the collectibles, you will have to decide whether

to dispose of the collection in your lifetime or leave that decision to

your heirs. If the latter, your family should — at a minimum — have a

basic understanding of your collection, its approximate value and how

you want it distributed. The default do-nothing alternative can present

a financial and emotional burden on your beneficiaries and lead to a

costly estate settlement.

42

Important questions to be discussed:

• Are there heirs who will want the collection from a collector’s

standpoint?

• Where are the objects kept?

• Where is the inventory of the collectibles kept?

• What is the approximate value of the collection?

• Has the collection been appraised? Was the collection appraised by

a qualified appraiser? Where is the appraisal and does it need to be

updated?

• Do you have legal title to the collectibles in your possession? If the

collectibles in your possession belong to someone else, do you have

power as Agent, Trustee, Guardian, or Executor to deal with them?

• Are there certain dealers or other experts such as an auction house

representative you trust to provide guidance to your heirs?

• Is there a firm that you and your heirs wish to use in the collection’s

disposition after your death? Is that firm noted somewhere in your

estate plans?

The horror stories that begin this chapter are all true, none are isolated

cases, and they won’t be the last. If, for whatever reason, you choose

not to to discuss your particular circumstances about the collection

with your family, consider choosing a trusted person or estate planning

professional to discuss your particular circumstances. You can also

take the time to write detailed instructions or simply make notes in this

book, and leave it in your safe deposit box or wherever you keep your

valuables.

The next few chapters help guide you through your options for

planning with collections. Whatever direction you and your family

choose for the handling of your collection, the written instructions can

be discussed with your estate planning advisor. Having thoughtful

discussions with your advisor and family, along with a valid document

stating your wishes kept with your collection’s inventory, will greatly

help your heirs when handling your estate.

43

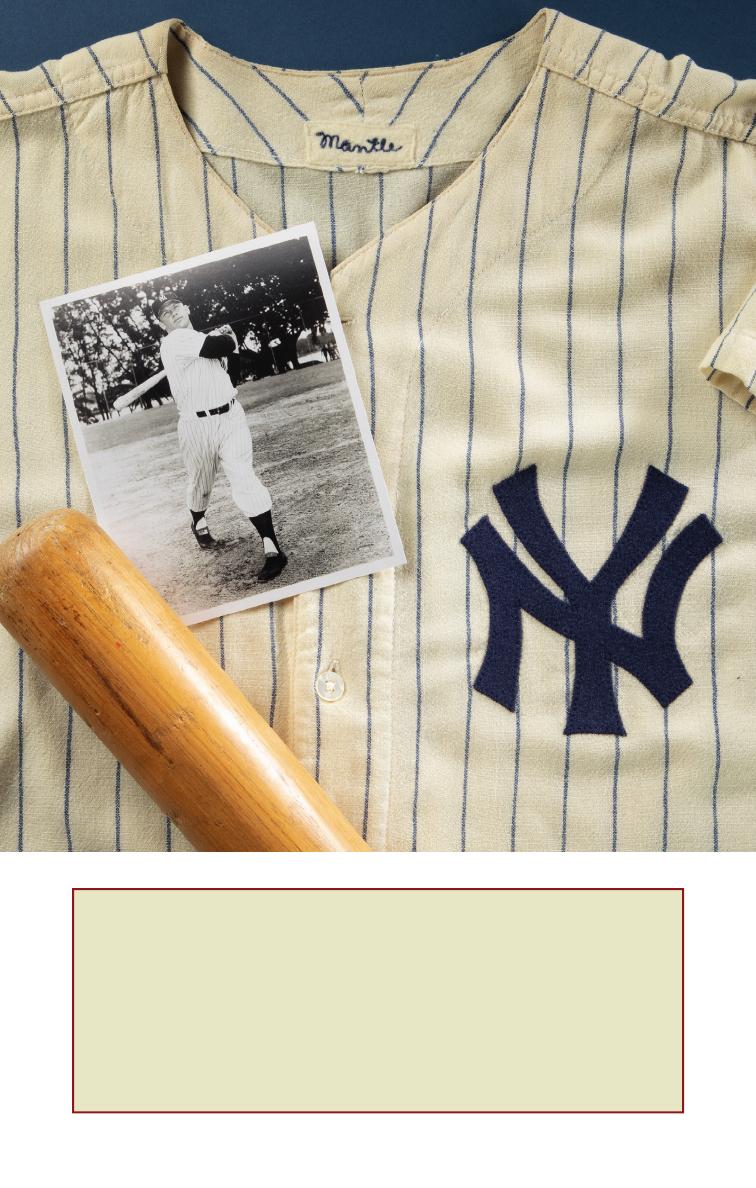

1958 Mickey Mantle Game Worn

New York Yankees Jersey, SGC

Superior/Superior-Excellent with

Multiple Photo Matches

Sold for $4,680,000 | August 2023

TIPS FOR HEIRS: This chapter does not address inheritance

issues, but communications can be initiated from any direction.

Do you have a parent with a collection? Certainly it is an issue that

requires tact, but such a discussion may save considerable difficulty

later. Additionally, if you know in advance that your spouse or relative

has named you as executor in a will or as trustee of a trust, a few

conversations about the collection will make your life much easier.

44

Story

Chris Ivy’s

Chris Ivy is the Director of Sports Auctions for Heritage

Auctions. He graduated with a BA in History from the

University of Texas at Austin and joined Heritage in 2001

after serving as a professional grader with Sportscard

Guaranty Corporation (SGC) in New Jersey.

Heritage Auctions consignment director Peter Calderon

was as skeptical of that first call as any reasonable person would have

been: a hoard of 700 baseball cards that are more than 100 years old

and in mint condition is something that never has happened before.

So when a stranger calls you up and says that’s what he has, it seems

dubious.

But when he showed me the photos on his cell phone, I was intrigued. If

it was what it looked like it was, this was a very, very big deal. The next

day, the family sent us a box with eight cards via FedEx. We confirmed

their authenticity and it would have been an amazing find even without

the roughly 692 cards that still remained in Defiance, Ohio, where we flew

as quickly as possible because the heirs were concerned about having

that kind of value sitting in a home.

The consigner was a man named Karl Kissner, who, as the executor of

his aunt’s estate, represented some 30 heirs, each of whom had a stake

in the collection. The cards had been stored in a box in an attic of the

modest home for a century, buried under an antique dollhouse. One card

had been out of the box during that time, exposed to the elements —

and it served as a reminder of what would have happened to the other

cards had they not been so well-preserved. But because of that box,

we were staring at probably the single greatest find in the history of card

collecting: ultra-rare cards depicting icons like Ty Cobb, Connie Mack,

Cy Young and Honus Wagner, all in conditions similar to the brand-new

cards you could buy today.

The question of how to sell the cards was challenging. At the time, the

universe of collectors for the set likely consisted of a grand total of fewer

than 50 people. The 1910 E-98 set was, paradoxically, so rare that few

people wanted it. High-end early baseball card collectors tend to be

relentless completionists — laser-focused on accumulating whole sets

— and the E-98 set was so elusive that few collectors had ventured to

45

try. The limited universe of collectors combined with the sheer size of

the collection meant it would be financial suicide to try to sell the whole

collection at once with a mega-auction.

Within the collectibles field, it is common for owners of hoards to sell

off their treasures piecemeal over time, while keeping secret the true

size of the collection out of fear that if people know how large it is, they

would wait for the prices to come down. As a result, the prices never

even start high.

With the family, we decided right away that wasn’t the way to do it. First,

we didn’t think it was ethical — and that if we followed the “slow leak”

approach, we would end up with a lot of disgruntled buyers who had

overpaid for the first few cards only to watch the prices come down.

Second, we knew that a cache of this size could attract tremendous

media attention — especially if the family was willing to serve as the

public face of it — and, with a set featuring a limited collector base

like this one, we thought media attention could expand that market.

We talked to the family about how to approach the press and the first

questions were, “What should we call it? What’s the name of the region

you’re from?” They told us it was known as The Black Swamp; at first,

we weren’t sure about calling it that. But while the name seemed a

little dark, we decided that it was intriguing and mysterious enough to

attract attention.

So we opted for a sort of hybrid approach. We would offer the story of

The Black Swamp Find to the media, but also would carefully sell off

the collection over the course of four or five years. We put out a press

release, and the first major story came from The Associated Press.

Local and cable news shows followed and, finally, the Today Show

called. The story appeared on literally thousands of traditional and

online media outlets.

Thirty members of the family came to the auction for the first few cards

from the Black Swamp Find; in total, the first 30 cards we sold realized a

combined $566,132. The family understands the importance of patience

in realizing full value for the collection, so it looks like I’ll be telling the story

of the Black Swamp Find for years to come.

46

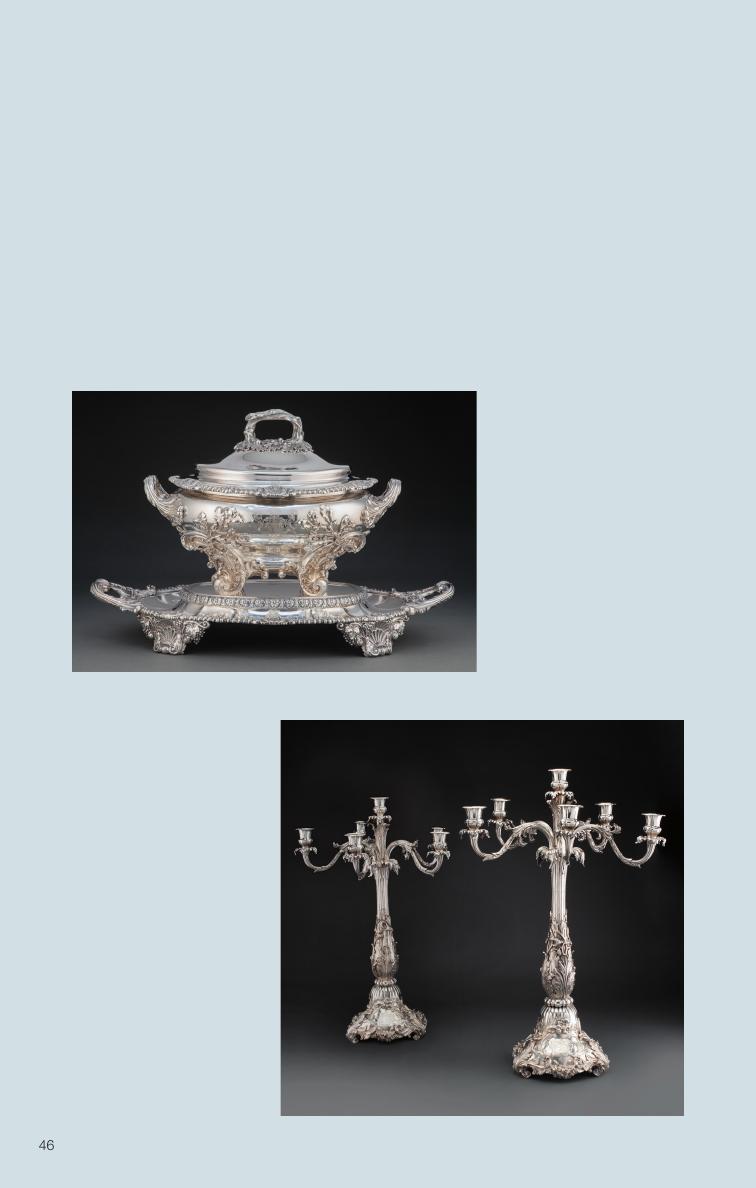

Mildred Hedrick Fender

Fort Worth, Texas

H

eritage was honored to present an impressive collection of fine

silver and decorative arts from the Estate of Mildred Hedrick